Has inflation peaked?

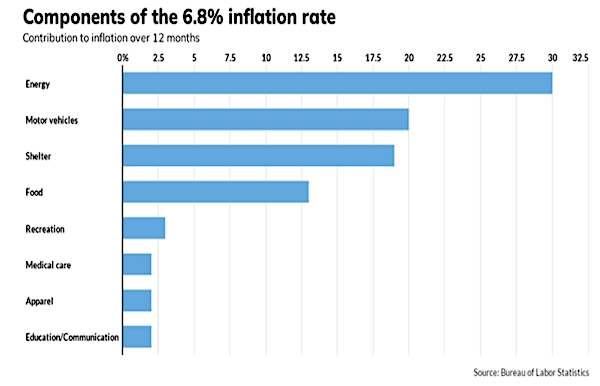

The Consumer Price Index (CPI) is an often-used gauge of inflation in the U.S. economy. On December 10, 2021, the CPI rate was a blistering 6.8 percent year-over-year (YoY), more than triple the Federal Reserve’s 2 percent target and its highest level since 1982. Even though energy takes up less than 8 percent of the typical household expenses, it accounted for 30 percent of the YoY gain.

Vehicles, shelter, and food were the next biggest contributors to the CPI. Along with energy, those four inputs represent almost 61 percent of consumer purchases but account for 81 percent of the YoY inflation. New vehicles prices have been up 11.1 percent in the past year and used vehicle prices have been up 31.4 percent. Shelter comprises about one-third of the household budget. Homeowner costs and rents have been through the roof (pun intended).

Interestingly, medical care prices are up just 1.7 percent YoY. College tuition, which rose at an annual rate of 6.7 percent in the 2000s and 3.4 percent in the 2010s, is up just 1.9 percent YoY despite a pandemic.

The economy and the stock market performed well after the Financial Crisis of 2009 because the “real” federal funds rate ranged from negative 1-to-2 percent for nearly a decade. (The federal funds rate is the target interest rate set by the Federal Reserve. Commercial banks borrow from the Fed at these overnight rates. The “real” rate is the rate adjusted for inflation — the nominal rate minus inflation.)

The stock market performed well from 2009–2018 as real interest rates remained negative. Stock prices took a hit at the very end of 2018 when the Fed raised rates to the point where real rates were positive by about one-half a percentage point. The stock market crashed quickly and viciously in reaction.

Current federal funds rate

Currently, the real federal funds rate is -6.8 percent. That is rare. The real federal funds rate was roughly -5 percent in 1974 and 1979. Rates dropped that low in response to the 1973 oil crisis and 1974 stock market crash, then the economic softening going into 1980 with the mid-1970’s turmoil still on the mind of the Fed. Then the real federal funds rate went very positive (almost 10 percent at one point) for a decade as Federal Reserve Chairman Paul Voelker hiked rates to combat inflation.

Yet, the economy and the stock market performed great. Well, after the economy went into recession, it and the stock market performed great. So, the Fed’s response could crush stocks in the short term. Nevertheless, in the long run, there is tremendous stimulus and innovation in the economy, and I expect a good decade — even if inflation causes a massive short-term shock.

In previous columns, I had suggested at least two rate hikes by the Fed in 2022 after it had completed the tapering of its bond purchasing program. Many others believe three hikes next year is more likely. The bulk of the hikes in this cycle could occur in 2023. Surveys expect the federal funds rate, currently at a range of 0.00–0.25 percent, will get to 1.50 percent in 2023 and 2.25 percent in 2024. Those are historically low rates but perhaps still high enough to force the U.S. into recession, given that those rates would be achieved from a shallow level.

Why would higher rates hurt the market? The average home price in the U.S. is $374,900. If mortgage rates go up with the federal funds rate — as they’ve been known to — do you think people will buy fewer or more of those houses if mortgage rates go from 3 percent to 5 percent? Of course, we could ask the same of cars or refrigerators or whatever. You get the point.

However, it’s more than just reduced spending that puts the stock market at risk. For any investment, the cost of money shapes the asset’s terminal value. The terminal value is a business value (I won’t bore you with the equation). All you need to know for now is that if you buy a business or invest in a project today, their values will decrease as interest rates rise. Higher interest rates increase the cost of capital. With business valuations tied to low interest rates, the terminal value of the companies that comprise the U.S. equity indices should be sensitive to even slight changes in the cost structure.

Relief from Inflation Peaking

U.S. inflation growth is likely near its peak and should start moderating next year. That is not a popular prediction. I mean, it’s a welcomed outcome, but not many people seem to share these sentiments.

Continued advancements in COVID-19 medical best practices and therapeutics combined with some improvements in supply-chain issues won’t necessarily reverse the direction of prices. Still, next year we’ll begin to see inflation growth closer to half of what it has been recently.

Readers probably think I am crazy. The 2021 YoY numbers were compared to prices when demand was substantially lower due to pandemic shutdowns. CPI went to nearly zero during the COVID crash. For 2022, YoY comparisons will be based on already higher 2021 prices.

This time next year, I expect YoY CPI growth to be closer to three percent, probably less than three percent. Improvement of the supply chains should reduce CPI by more than a percentage point. The new YoY price comparisons should reduce CPI by nearly double that amount. An expected decline in the cost of vehicles and durable goods should offset continued shelter inflation. Energy prices are so volatile that it’s a guess as to its contribution. Still, I suspect the cost of energy will also ease.

It appears as if the bond market agrees with my assessment. With inflation surging as it has, you’d expect long-term interest rates, as measured by the 10-Year Treasury Note, to also be rocketing higher. However, ever since inflation crossed above the 2% threshold after dropping to nearly zero during the COVID crash, the yield on the 10-year has actually declined. Fed purchases of bonds have helped keep rates low. Still, if the markets were as worried as analysts about inflation pressures becoming a long-term issue, there would be more upward pressure on long-term rates.

Profit Margins in 2021

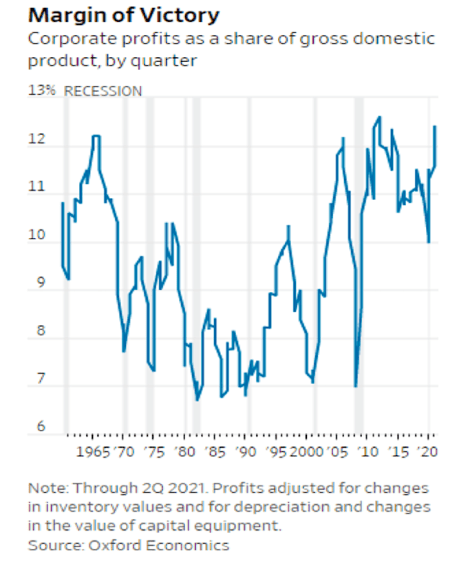

For now, inflation has proved to be a positive for corporate margins. According to Vistage Worldwide, a business peer-advisory firm, 60 percent of small-business owners increased prices in the previous 90 days. This allowed those companies to pass higher labor and input costs onto the customer. If they are anything like their publicly traded counterparts, many have raised prices faster than costs, thus increasing profit margins. According to FactSet, nearly two-thirds of U.S. publicly traded companies have reported wider profit margins in 2021 relative to the same periods in 2019.

Profit margin improvement has helped ease valuations a bit. As a share of gross domestic product (GDP), total profits for U.S. corporations hit its second-highest recorded level since 1960.

Inflation will trigger higher interest rates. Before higher interest rates spark a recession, there’s still some room for the stock market to rise. But for how long?

Allen Harris is the owner of Berkshire Money Management in Dalton, Mass., managing investments of more than $700 million. Unless specifically identified as original research or data-gathering, some or all of the data cited is attributable to third-party sources. Unless stated otherwise, any mention of specific securities or investments is for illustrative purposes only. Adviser’s clients may or may not hold the securities discussed in their portfolios. Adviser makes no representations that any of the securities discussed have been or will be profitable. Full disclosures. Direct inquiries: aharris@berkshiremm.com.

This article originally appeared in The Berkshire Edge on December 20, 2021.

Allen is the CEO and Chief Investment Officer at Berkshire Money Management and the author of Don’t Run Out of Money in Retirement: How to Increase Income, Reduce Taxes, and Keep More of What is Yours. Over the years, he has helped hundreds of families achieve their “why” in good times and bad.

As a Certified Exit Planning Advisor, Certified Value Builder, Certified Value Growth Advisor, and Certified Business Valuation Specialist, Allen guides business owners through the process of growing and selling or transferring their established companies. Allen writes about business strategy in the Berkshire Eagle and at 10001hours.com.