US economy today: is this a recession or just a growth scare?

On May 19, 2022, I attended an invitation-only webinar. It was hosted by FSInsight and presented by DeMARK Analytics. Fundamental portfolio managers check their work through FSInsight. Technical analysts check their expectations through DeMARK Analytics. Early in 2022, FSInsight nudged me to rotate some of my growth positions to value when they predicted that the first half of the year would be “treacherous” for stocks. DeMARK did their followers a solid by calling the bottom of the COVID-19 crash not just to the day but to the hour. Given the pedigree of these research services, it is worthwhile to share their findings with you.

Current predictions from DeMARK

DeMARK argued that last week was the bottom (or, at least, a bottom) for the S&P 500. Specifically, they expected one more sell-off, with two closes below 3,858 points. That further decline didn’t happen last week (at least not when I submitted this column). Time will tell if they’re right about last week being a bottom. DeMARK expects a “shocking” rally to 4,453 points (about 15%). They suspect that there is not much downside left for the NASDAQ.

DeMARK expects the yield of the 10-year Treasury to reach one more high, which will be its peak for this cycle. They expect crude oil to have topped last week ($117.29 being an upside limit). DeMARK predicts that commodities, in general, are nearing a top. FSInsight points out that there are fundamental reasons for commodities prices to continue rising (war, Chinese demand, crop cycles), but commodities often adhere to technicals.

Has the NASDAQ fallen far enough for a significant bounce back?

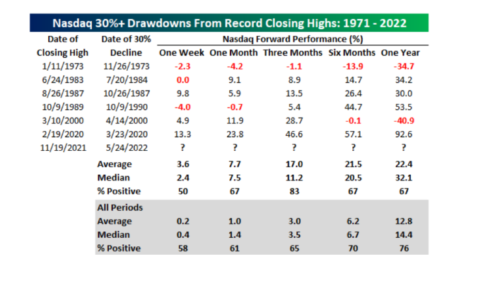

May 25, 2022 was the 100th trading day of the year. The NASDAQ is off to its worst start to a year ever. On May 24, 2022, it closed nearly 30% below its November 19, 2021 all-time high (-29.8%, to be exact). The NASDAQ’s decline during the COVID crash was 30.1%. Is that enough pain for the NASDAQ to bounce back and have a great next year? Yes-ish.

There have been six instances in NASDAQ history where it has closed down 30%. As you can see from the Bespoke chart above, the average return one year after it had such a decline was 22.4%, or nearly double the index’s typical return of 12.8%. Interestingly, in each instance, the returns were (at least) relatively stable for the next three months. However, in two out of six of those instances (1973 and 2000), the NASDAQ continued to blow up one year later.

DeMARK may be right that the bottom is in. I have argued for the strong probability of a May 22, 2022, low (which I realize was a Sunday, but my metric followed calendar days, not trading days). But even if we get a rip-your-face-off rally from here, we still need to reassess. Consider the massive rally from the 2020 lows. At that time, the Federal Reserve cut interest rates, and fiscal stimulus pumped cash into bank accounts. Today, the Fed is raising interest rates, and the government is jawboning down inflation. We could be on the precipice of a summer rally, only to see the stock market fade into a long, cold winter.

Is the US economy in a recession?

Last week I quickly mentioned that “the U.S. economy is in a recession right now.”

The National Bureau of Economic Research’s traditional definition of a recession is a significant decline in economic activity spread across the economy and lasts more than a few months. Well, in that case, I’m probably wrong. Growth of the U.S. Gross Domestic Product (GDP) for this quarter, the second quarter of 2022, should be close to a relatively robust 2.4%.

I did note that “the economy is not in a recession based on traditional definitions. However, GDP is flatlining, housing (and so much more) is costly, and we can’t get our babies the formula they need. So, I’m going to call it a recession, even if it isn’t technically one.”

Nonetheless, the conversation about the “when” (not “if”) of a recession has been pervasive. Next week, I’ll be presenting at the 36th Private Wealth Management Summit in Boston. The audience is primarily other professional investors deciding where to allocate client capital. My presentation is titled “Taking a Deep Dive into Economic Expectations and Implications for Investors.” Macroeconomics is on the mind of practically every professional investor. (And if it’s not, it should be!)

Recession or growth scare?

I think the U.S. economy is weak enough to say it’s in recession. However, many in the crowd at the 2022 World Economic Forum (WEF) in Davos, Switzerland, disagree with me. The WEF is often referred to simply by its host city — Davos. Davos is often ridiculed as elitist because it brings in the world’s wealthiest and most influential thinkers to try to solve the world’s problems. Elitist as it may be, I should pay attention when people more successful than me starkly disagree with my hypotheses. It’s possible that what the economy is experiencing isn’t a recession but rather what some call a “growth scare.” Consider the Davos interview of Brian Moynihan, CEO of Bank of America, regarding customer assessment:

- Spending levels in May 2022 are up 10% compared to May 2021

- Although spending is up, bank account balances are up 8% year-over-year

- Bank customers who had balances between $1,000–$2,000 in February 2019 had an average of $1,400; those same customers had $4,000 in April 2022

- Bank customers with balances between $2,000–$5,000 in February 2019 had an average of $3,500; those same customers had $13,000 in April 2022

- Retail sales are flattening out, but spending on experiences is up (for example, spending on travel is up 40% year-over-year)

There are others in Davos, like me, with a more pessimistic tone than Moynihan. But those fundamental data points Moynihan cites give me some hope that DeMARK’s technical analysis is sound.

Allen Harris is the owner of Berkshire Money Management in Dalton, Massachusetts, managing investments of more than $500 million. Unless specifically identified as original research or data-gathering, some or all of the data cited is attributable to third-party sources. Unless stated otherwise, any mention of specific securities or investments is for illustrative purposes only. Adviser’s clients may or may not hold the securities discussed in their portfolios. Adviser makes no representations that any of the securities discussed have been or will be profitable. Full disclosures. Direct inquiries: aharris@berkshiremm.com.

This article first appeared the The Berkshire Edge on May 30, 2022.