S&P 500 Spiked 6.58% at June Rally | Impact on Index & Moving Averages

In last week’s Capital Ideas column, I reminded readers that I had been betting there would be a “rip-your-face-off” rally after May 22, 2022. One week does not a rally necessarily make, but the week after that column was published, the S&P 500 spiked 6.58 percent. That was the 53rd rally of 5 percent or more for the index since World War II (1945). Let’s be clear — I ain’t bragging. There’s way more luck in this line of work than I’d like to admit. The best I can do, at times, is to work hard enough to get lucky sometimes. Besides, that was then. It’s about what’s next.

If history is a guide, last week was probably a down one for the stock market. The good news is that things could get a lot better. The months after weeks in which the S&P 500 gains 5 percent or more, the index performs well, historically speaking.

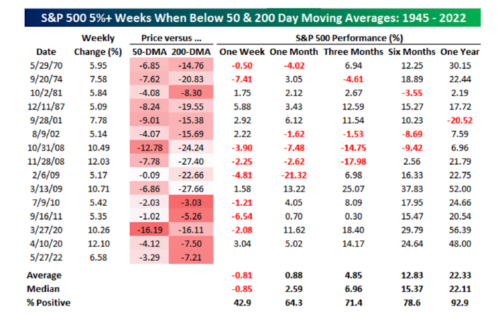

The bad news is that even after that 6.58 percent one-week rally, the S&P 500 remained below its 50- and 200-day moving averages. When an investment is below those moving averages, they’re considered to be in a downtrend. When an asset is in a downtrend, it’s more challenging to regain upside momentum. As a result, on average, following similar one-week rallies, the stock market tends to give up some of those gains the following week. But then things improve.

Returns are better, on average, when those one-week rallies occur when the index is above its 50-day and 200-day moving averages (i.e., in an uptrend). However, even when the market is in a downtrend, those big weeks tend to be the start of something more significant.

According to the Bespoke chart above, when the stock market was in a downtrend, weeks with gains greater than 5% led to average returns of 12.83 percent and 22.33 percent six months and one year later, respectively.

Unfortunately, the month of June has traditionally been weak for the stock market. Throughout the last 20 years, the Dow Jones Industrial Average has declined by 0.52 percent in June. We could see some of that before the market gets some traction.

How is inflation impacting the stock market?

It’s not inflation that is bad for the stock market. The things that must happen to reduce inflation are what’s bad for the stock market. The task for investors is to determine how much pain the economy must endure to return inflation to target.

The Federal Reserve has said that its inflation target is 2 percent. The most often cited measure of inflation is the consumer price index (CPI), which is 8.2 percent year-over-year. The Fed has told us that their preferred measure of inflation is the Personal Consumption Expenditures (PCE) price index. The PCE is 6.3 percent year-over-year. That’s still extremely high, but a little closer to 2 percent than 8.2 percent. That means the Fed has a little less distance to go. The Fed has already gone far enough to do the things that reduce inflation.

Layoffs are picking up. Anecdotally, companies are finding it more difficult to continue raising prices for consumers. U.S. housing is slowing. I believe oil prices are peaking. Large corporations have shifted from not having inventory to being overstocked. Additionally, Europe’s economy is taking a body blow. Aggregately, these point to inflation coming down.

The counter to that hypothesis is robust consumer demand in the U.S. Those variables combined equal the Federal Reserve’s expected path of interest rate hikes. That path is a headwind for stocks but not an oncoming train. The bet I am making with my portfolio is that inflation has peaked; thus, a substantial enough low has been made in the stock market so that I don’t feel financially uncomfortable.

Allen Harris is the owner of Berkshire Money Management in Dalton, Massachusetts, managing investments of more than $500 million. Unless specifically identified as original research or data-gathering, some or all of the data cited is attributable to third-party sources. Unless stated otherwise, any mention of specific securities or investments is for illustrative purposes only. Adviser’s clients may or may not hold the securities discussed in their portfolios. Adviser makes no representations that any of the securities discussed have been or will be profitable. Full disclosures. Direct inquiries: [email protected].

This article first appeared in The Berkshire Edge on June 6, 2022.

Allen is the CEO and Chief Investment Officer at Berkshire Money Management and the author of Don’t Run Out of Money in Retirement: How to Increase Income, Reduce Taxes, and Keep More of What is Yours. Over the years, he has helped hundreds of families achieve their “why” in good times and bad.

As a Certified Exit Planning Advisor, Certified Value Builder, Certified Value Growth Advisor, and Certified Business Valuation Specialist, Allen guides business owners through the process of growing and selling or transferring their established companies. Allen writes about business strategy in the Berkshire Eagle and at 10001hours.com.