Berkshire Business Confidence Index, Issue 6

Table of Contents

Summer 2018 results from the Berkshire Business Confidence Index, sponsored by Berkshire Money Management

The Berkshire Business Confidence Index (BCI), sponsored and analyzed by Berkshire Money Management, indicates that there is a high level of optimism among Berkshire County businesses, as well as non-profit organizations that must make business decisions. We mailed out 4,000 surveys countywide, and received responses from the full spectrum of Berkshire industries—non-profits, retail, manufacturing, finance, lodging, real estate, construction. Each brings their own voice to this survey. What we have gleaned from this month’s results:

- From the last survey (April 2018) to this survey, overall confidence was up slightly, from 56.1 to 58.6. The most notable improvements came from respondents’ view of overall business conditions from the last survey as well as year-over-year sales.

- Notable improvements in the view of overall conditions have prompted businesses to build inventory.

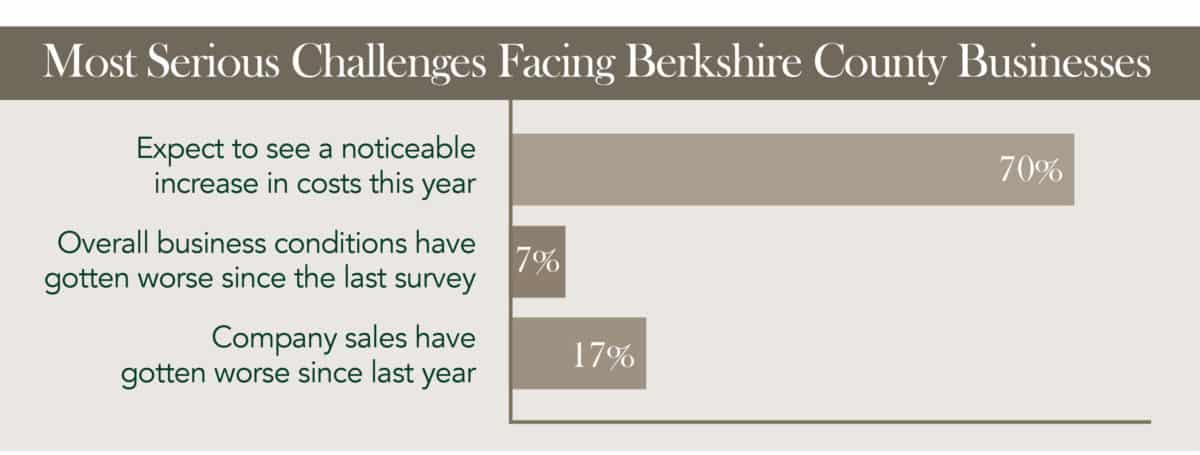

- There was one negative component to the BCI this quarter – increased costs. Costs had the dubious distinction of being not only the only component to drop (in confidence), but also the sole negative component.

The ‘Numbers’

The Berkshire BCI for this survey period is 58.6, up slightly from the last survey’s 56.1, signaling continued optimism among Berkshire County businesses and organization leaders. A reading of greater than 50 signals increased economic activity. Less than 50 indicates a contraction in activity, and 50 corresponds to no change. Over time, as we continue reading and analyzing the surveys, the trend of that number will be important in determining the direction of confidence. Today, county businesses have mixed feelings, but are generally more optimistic. Let’s look more closely at the areas in which we collectively see opportunities or challenges by addressing some of the survey questions individually.

The Questions

How have overall business conditions changed since the last time you responded to this survey?

In the last survey, the second most negatively skewed question was this one. This quarter it was still the second most negatively skewed question (a neutral 50), but it had the biggest positive jump of 11.7 points.

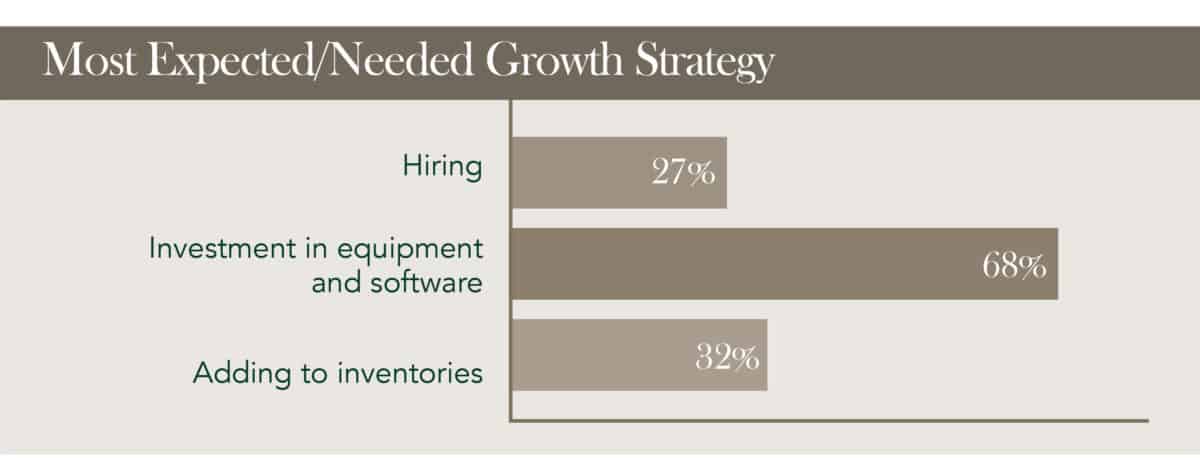

We had pointed out that the BCI for the Winter of 2017/2018 saw a massive spike in year-over-year sales and thus we expected what we had called a “sales hangover” in the Spring 2018 quarter, and we were right. Business owners interpreted that coincident data (coincident meaning “happening now”, as opposed to leading or lagging indicators) as a majorly negative change to business conditions. This quarter, while the national economic growth rate (as measured by Gross Domestic Product) went gangbusters, Berkshire-based business owners shook off that hangover and felt the strength of that growth. In response, area businesses are stocking more inventory in anticipation of continued expansion. The number of businesses adding modestly or substantially to their inventories was 32% compared to 26% last survey.

How strong are your company’s or organization’s sales compared to last year?

Due in part to the recovery from the “sales hangover,” meaning there was pent-up demand from customers, this component enjoyed the second biggest jump, up 8.5 points to 61.6.

Is your company or organization investing in new equipment and software?

Coming in at 69.4, this has consistently been the second highest contributing component to the BCI. And, this time around was no different. (The consistently first highest, as it was this survey, has been access to financing, which came in at 75.0.)

Is your company or organization hiring?

The intention to hire fell 3.2 points to 58.9. That is still above 50, which indicates growth. The number of respondents with modest-to-substantial hiring plans dropped from 32% to 27%.

Have tariffs, either announced or threatened, affected your business?

20.7% said yes; 69.3% said no. We didn’t make this an open-ended question but; 1) We do ask what industries that respondents work in, and 2) Some respondents help us out by writing additional comments in the margins. The “yes” answers to this question seem to be only impacting industries that need to acquire goods that have seen prices rise. BMM has done the math on tariffs (enacted and threatened) and a lot of that work has been posted on my LinkedIn page (me, Allen Harris). The math shows that the amount affecting overall business (i.e. compared to GDP) is extremely small. That simple math does not concern us; the emotional calculus is a threat. Our bigger concern has been how the threat of trade wars would impact consumer mentality and slow sales. Thus far, in the Berkshires, while there seems to be some cost and price pressures for specific industries (security & locksmiths, electrical contractors, construction, heating oil sales & service, and costume jewelry), it doesn’t seem to be slowing down economic growth overall.

Why the Berkshire BCI?

Your job is to handle the challenges of unsystematic risk specific to your business, whether that is to decide on the best recruiting methods to build and sustain a reliable workforce, or to deliver a new service/product line to keep up with a changing marketplace. The main mission of the Berkshire BCI is to give you the information you need to make business decisions confidently and to provide potential choices, thus creating the opportunity to make better, more informed decisions. The BCI can identify problems and then we, as a business community, can use each other as a resource. We are finding that area businesses want to share their good business ideas, and help others steer clear of mistakes. We see this dialogue as a tool for all of us to share collective information so as to more confidently make changes and add value to our businesses.

The Bottom Line

Things look good. I’ve been very vocal for a number of years that the U.S. will experience a recession in 2020-2022. When I said that five years ago, I had the comfort of nearly a decade to come to see what would happen and the opportunity to change my mind as new facts came to bear. However, I’ve been consistent about that timeline as data continues to support my expectation. With 2020 being only 15 months away, that doesn’t leave a lot of wiggle room at this point.

Recessions are interesting. It’s about dispersion. One area weakens, then another. Then another. Until enough regions are simultaneously weak enough for the entire country to tilt into recession. Not all areas need to be in recession for the U.S. to be in recession. And some areas can be in recession as the country, in aggregate, is doing well. Since we have been tracking local data via the BCI, Berkshire County data has been running in lockstep with the aggregate U.S. data. And it has also been consistent with the Associated Industries of Massachusetts’ (AIM) state survey. That gives us extreme confidence in our survey methodology and sample size.

Berkshire Money Management has been around since 2001, and since then we have an astounding track record of calling 100% of the national recessions. (Since there have only been two recessions since 2001 we hope you can see we’re not really patting ourselves on the back too hard for doing our job.) As professional investors, our job is to get out of the stock market when that happens and then to get back in after the damage is done.

As consultants to business owners trying to accelerate their business, the BCI is important to us so that we can help people make better decisions about how to manage their operations and financials. For example, the third biggest jump in this survey was to the question “Is your company or organization adding to inventories?” No doubt business owners added to inventory because their overall sentiment of business conditions improved. However, adding to inventories, or hiring new workers, or adding that extra machine at an inflection point prior to a recession adds unnecessary expenses to your business at a time when your sales decline and you might otherwise consider cutting costs.

But, right now, things look good. Berkshire Money Management bought a new building, and we’ve hired three new people to our small firm in the last year. Given that we expect a U.S. recession by 2020-2022, that may mean our costs will be higher than we would otherwise like at that point. But there are ways to control sales. In the investment management portion of our business, that means protecting client portfolios. And while we like to think we do good things for our clients (check out the “Extra Mile” page on BerkshireMM.com), I can tell you what won’t help sales when it matters most. Unfortunately, per one of the survey questions we’ll explore in the following byline, I fear that “good” customer service is considered the main ‘strategy’ for many of our local business owners.

I’m not good at making friends

In our last Berkshire Money Management business roundtable my fellow business executives shared how important they thought it was to have good customer service and that, in fact, good customer service is what kept their clients coming back. I couldn’t hold my tongue. I vehemently disagreed. Telling people that their customer service isn’t good enough to keep customers coming back is not a good way to make friends. But if I wanted to make friends I’d send you flowers, not data. So, instead, I’ll make you hate me and tell you some truths.

One of the questions in the survey was, “Consumer confidence is nearly at an all-time high, but expectations are slipping. Are you trying to book business today so that you don’t lose the clients later?”

3.6% said, “Yes, the economy is clearly going to slow and we need to book revenue now before our customers change their minds”. I thought that was telling. (Another 53.6% said they always try to close the deal sooner.)

Another 3.6% said, “No, we’ve got too much business right now and have to put people on a waiting list.” To an equity investor like me, that’s music to my ears. However, as someone who helps owners build their businesses, I felt this searing pain in my face when 39.3% said, “No, our customers are loyal and will be there later.”

This is where we stop being friends – you’re wrong. Humans aren’t coming back to you because of your good customer service. They are coming back to you because they are subject to status quo bias. Or, at least, that’s the way you should view it. They come back to you because they are used to you. And if that’s your intended strategy to win more business, you risk losing market share to your local competitors and/or national industry disruptors.

If you are still reading this and haven’t thrown it in the recycling bin out of disgust, I’ll admit that I’m prone to hyperbole to get my point across. Good customer service is an incredibly important metric. It just can’t be your only differentiator if you want to keep (or hopefully grow) market share.

Accelerate Your Business

I generally use my LinkedIn account to talk about the stock and bond markets, but if you’d like to see some more information on that subject matter there, just send me a message to let me know there is interest and I can start creating some more content based specifically on what would be of value to you.