Berkshire Business Confidence Index, Issue 1

Second set of results from the Berkshire Business Confidence Index, sponsored by Berkshire Money Management are available in PDF format here:

Table of Contents

First set of results from the Berkshire Business Confidence Index, sponsored by Berkshire Money Management

This month’s inaugural Berkshire Business Confidence Index (BCI), sponsored and analyzed by Berkshire Money Management, indicates that there is a cautious level of optimism among Berkshire County businesses, as well as non-profit organizations that must make business decisions. We mailed out 5,000 surveys countywide, and received responses from the full spectrum of Berkshire industries— non-profits, retail, manufacturing, real estate—each bringing their own voice to this survey. Respondents were eager to share with us what they felt were advantages and disadvantages to setting up shop in the Berkshires. What we have gleaned from this month’s results is:

- Berkshire County businesses are anticipating modest growth over the next year.

- Businesses want to hire, but they are struggling to find skilled/trained labor.

- Businesses are investing in new equipment and software, thus enhancing productivity and modernizing workflows.

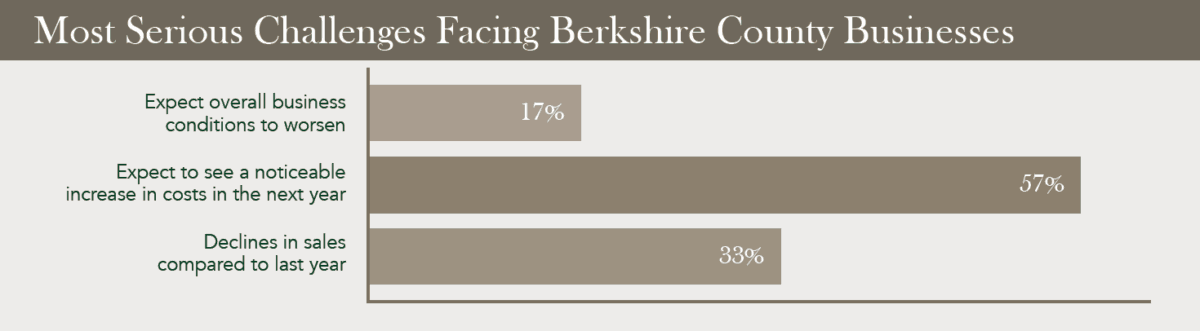

The ‘Numbers’

The first survey results for the Berkshire BCI is 54.8, signaling optimism among Berkshire County businesses. A reading of greater than 50 signals increased economic activity. Less than 50 indicates a contraction in activity, and 50 corresponds to no change. Over time, as we continue reading and analyzing the surveys, the trend of that number will be important in determining the direction of confidence. Today, county businesses have mixed feelings but are generally more optimistic. Let’s look more closely at the areas in which we collectively see opportunities or challenges by addressing some of the survey questions individually.

The Questions

Is your company expecting to see a noticeable increase or decrease in costs this year?

The answers to this question contained the most negative skew. In the spirit of transparency, we believe that we could have done a better job at framing this question, offering respondents an opportunity to gauge an increase or decrease in sales as something more moderate than “noticeable.” To the credit of one of our respondents, we were prompted to consider modifying this question in response to another question, What is the greatest opportunity the Berkshires will provide to your company over the next 12 months?

This month’s inaugural Berkshire Business Confidence Index (BCI), sponsored and analyzed by Berkshire Money Management, indicates that there is a cautious level of optimism among Berkshire County businesses, as well as non-profit organizations that must make business decisions. We mailed out 5,000 surveys countywide, and received responses from the full spectrum of Berkshire industries – each bringing their own voice to this survey.

This open-ended question garnered some thoughtful answers from across the business community. The comment we referenced above was from the retail jewelry sector, stating that “The saving grace for us is stability. Growth would be a welcome change but … stagnant employment combined with escalating taxes and health care costs are a huge hurdle for the average incomes in the area.”

A positive counter to the above comment is that Berkshire-based businesses see a modest improvement in overall business conditions in the six months to come. Many are likely feeling this confidence because, over the last few months, they have been able to modestly raise prices for their goods and services, even as sales have been somewhat flat over the last year.

Is your company hiring?

There appears to be a strong demand by area businesses to add to their workforces, but only if they can find the right employees. To that end, or despite wanting to hire new employees, many businesses—health care, design services, construction, film, advertising, metal manufacturing, mental health, non-profits, financial services—cited “A lack of skilled labor” as, by far, their greatest challenge. According to a respondent in real estate management, “No one has been willing to relocate, and it is nearly impossible [that] individuals with professional qualifications [are] already living in the area.”

Is your company investing in new equipment and software?

The majority response to this question is “yes.” This is encouraging for overall economic growth, and also to the mindset of decision makers who clearly want to modernize.

There are also positive skews toward the intent to invest in new office space in the Berkshires, and add to inventories in anticipation of increased sales. If businesses require financing for such, respondents share that they have reasonable access to financing.

Challenges, and the power of ‘perception’

Challenges, and the power of ‘perception’

A major disadvantage to doing business in the Berkshires is the perception, at least according to a respondent in the insurance industry (and other respondents who mirror this sentiment), that “the county is dying a slow death” when it comes to business growth and employment. It is important to note that we use the word ‘perception’ here. BMM can cite a variety of metrics to come up with an assessment of whether the ‘death of the Berkshires is real,’ or exaggerated. However, the BCI is not about BMM’s independent data analysis. The BCI is about aggregating YOUR thoughts. In so doing, yes, there is some interpretation of the numbers. However, we purposely asked some open-ended questions that did not become part of our numerical assessment but that could either support or negate our mathematical interpretation.

We are steering clear from the concept of the area actually dying because overwhelmingly respondents see more advantages than disadvantages. Respondents commented that the Berkshires has a “small-town feeling where you can make sales and customer service very easy” and where you can get to “know people on a personal level.”

Respondents also point out that the “quality of life living” and “tourism” are tremendous resources for most respondents in every industry.

Closures, exits

Clearly, in the category of closing companies being a drag on business, Sabic leaving the area has created the greatest concern. Also, the closure of the North Adams Hospital is a notable mention, as well as the downsizing of Crane & Co. There were specific business closings that affected singular Berkshire-based businesses, such as losing a supplier or buyer. One respondent summed up this concern with the comment, “any company closing impacts all other companies,” implicitly arguing that efforts to support local businesses have a level of importance similar to that of the creation of new businesses.

Other thoughts and suggestions

Other thoughts and suggestions

It was suggested that the Berkshires could battle the ‘slow death’ perception with positive “consistent publicity on a Berkshire website or publication.”

Property taxes are mentioned frequently. However, the flaw in the anonymous nature of the index is that the specific town(s) of concern remains unknown. But, it is fair to say that Berkshire County towns with high property taxes are at risk of losing business to outside towns with lower property taxes.

In regards to bringing in more tourism by way of vibrant downtowns, it is opined that there is “not enough retail.” This could be considered a current disadvantage, yet a more optimistic viewpoint could be that there is more opportunity for retailers to set up shop.

There are advantages for particular industries, including one respondent in the forest products industry who commented on “the ample supply of timber in the area to harvest.” Disadvantages by industry also exist, according to a non-profit who cites “a shrinking philanthropic community.”

Why the Berkshire BCI?

The BCI can identify problems and then we, as a business community, can use each other as a resource. Some things are, in aggregate, too big of a scope for a quick fix (like expanding the talent pool of workers), but we may be able to

help each other in terms of how we’ve recruited. For example, not to get into personal assessments, Berkshire Money Management has had success with hired headhunters as well as using interns to develop personnel. I am envisioning this dialogue not as a tool for us to coax government officials to make changes gradually, but rather a tool for us to all share collective information so as to more confidently make change and add value to our businesses.

The bottom line

Berkshire businesses see sales and pricing improving modestly over the months to come. This is likely why they are eager to hire. There seems to be demand by area businesses to add to their workforces, if they can find the right employees. However, there is clearly a frustration among Berkshire businesses that there is not a strong talent pool from which to select. This challenge will limit growth potential.

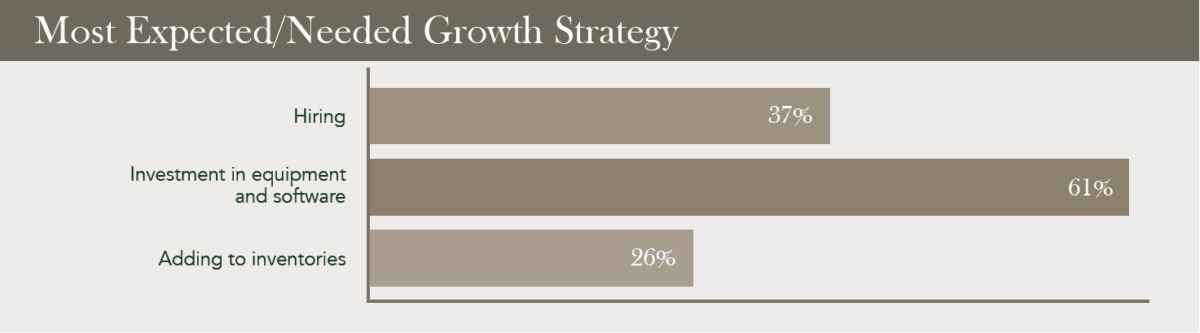

Amazonification of America

If I may editorialize a bit, it was cited that one challenge the Berkshire will be confronted with is the “ability to maintain reasonable prices while dealing with increases in every aspect of the business.” This is a national phenomenon for retail businesses. At BMM, we refer to it as the “Amazonification of America.” The cost of goods sold is increasing, but there is continued relative pressure on pricing, thus squeezing margins in corporate America. This has been good for us as consumers, but is a challenge for us as business managers. If you are in retail, you already feel it.

Some of your competitors may have already gone out of business because they were not prepared for the disruption. The Amazonifcation of America has changed the way we shop, the way we watch entertainment, the way we diagnose illnesses, and it has blunted our differentiators as our goods and services are suffering from the creeping perception of commoditization where the competitive advantage becomes price. If it has not happened to your industry yet, I dare say it will.

Disclosure: Investment in securities, including mutual funds, involves the risk of loss.

Challenges, and the power of ‘perception’

Challenges, and the power of ‘perception’ Other thoughts and suggestions

Other thoughts and suggestions