You’ll pay more, and you’ll like it!

Usually, when inflation creeps up, consumers switch buying habits. If beef prices go up, consumers buy more chicken. Or, if the kids’ shoes are too costly at Macy’s, parents might go to Target or Walmart. Generally, that’s not occurring in this cycle.

I present those specific names as conceptual examples. Walmart is doing quite well. However, Walmart’s performance is not necessarily because consumers are looking for lower prices. Walmart is a behemoth and has had the power to keep its shelves and in-store restaurants stocked while its competition suffers inventory shortages. That’s not a hypothesis. Walmart Chief Executive Doug McMillon said as much on February 17, 2022. McMillon explained how the company’s scale has allowed it to flex against manufacturers to receive considerably more products.

But instead of spending less, consumers are spending more. Retail sales surged 3.8% in January 2022, nearly doubling expectations (that’s goods, not services, although restaurants are included, just to be precise). That is not adjusted for inflation, so a part of the spending increase was higher costs. However, it’s more than that – U.S. consumers are quite active. Especially online. But not just online. For example, Chipotle CEO Brian Niccol said on February 8, 2022, that the restaurant chain hadn’t seen any resistance to higher prices from customers. For brevity, I won’t include a bunch of other examples. The point is that when consumers can find what they want amidst the inventory shortage, they’re willing to pay to get it.

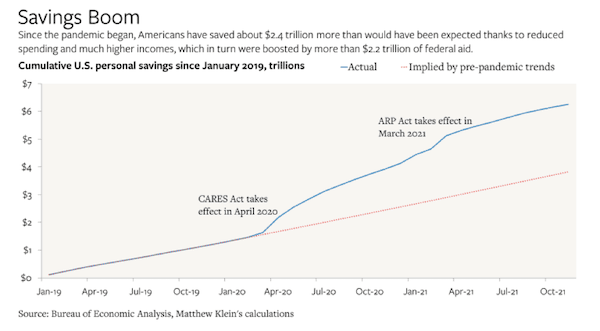

My guess as to why this is (and now I am in hypothesis mode) is a two-part theory. Both parts are based on facts. First, consumers are flush with cash. A year ago, consumers had roughly $1.6 trillion of “excess cash.” According to The Overshoot, the level of excess cash is currently closer to $2.4 trillion.

That’s the fact. The hypothesis is that people feel okay spending more money when they have more money.

I remember a couple looking at some art pieces, and the wife said to the husband, “I feel nervous. We spend tens of millions of dollars now like we used to spend hundreds of thousands.” Nice problem to have, huh? They were successful entrepreneurs, and their spending increased along with their net worth. I know it sounds hyperbolic, but hyperbole drives home the point. I bet your neighbors have done similar things. They get a raise, and put a deck on the house. They get a promotion, and buy a new car. The more I think about it, my hypothesis is close to fact. The plural of anecdote is not data, but you know this is true.

My second hypothesis is that people expect inflation to be transitory. If consumers don’t feel higher prices will be permanent, consumers are less likely to seek alternative buying options. Year-over-year, inflation recently clocked in at 7.5%. According to a January 2022 survey by the Federal Reserve Bank of New York, consumers expect inflation to average 3.5% over the next three years., not 7.5%.

So, what does it all mean? Because people are paying more and don’t seem to mind (yet), inflation will remain persistent. Consequently, I expect the Fed will need to slow the economy more than it would otherwise to bring inflation down. A slower economy makes it tougher to squeeze gains from the stock market.

I explain that to tell you this: on February 16, 2022, the team at Berkshire Money Management held one of its (not so) legendary investment committee meetings. The TL;DR of the marathon meeting is that there weren’t many changes to be made. But there are themes we need to consider that will likely drive future changes. The most significant theme of that meeting is that it’s hard to manage investment-grade bonds paying 2% when inflation is running at twice, thrice, or even more than that level.

We discussed bond alternatives. Bonds traditionally play a role in a portfolio to provide income, diversify away risk, and reduce volatility. However, we’re not going to feel good about holding certain types of bonds over the next couple of years if inflation is eating the returns of those bonds. I prefer to invest in the stocks of companies that have things people are willing to buy at higher prices (see how I went full circle there?).

Still, being invested in 100% equity isn’t suitable for all portfolios. I am considering using more buffer funds (funds that protect you from some of the market’s drop but allow you to potentially capture some equity upside). I am also considering floating rate bonds (existing loans that adjust their rates higher in real-time). We discussed further exposure to real estate investment trusts (REITs) or utility stocks. However, if I am looking for a bond alternative, I need more than just a favorable yield; I need low volatility.

I currently own three general types of bonds. I own short-term corporate bonds, and I’m looking for an exit strategy. The short duration keeps them reasonably stable, but the yield is sub-2%. That’s not going to be enough to fend off the erosion of inflation.

I own Treasury Inflation-Protected Securities (TIPS). Betting on inflation, in retrospect, turned out to be a good idea. But I’m not happy with the returns of TIPS compared to more aggressive bets I could have made, such as some commodities. A big part of that is because TIPS is more correlated to inflation expectations than actual inflation. And as I mentioned earlier, while inflation is sky high, somehow, expectations remain relatively low.

I also own short-term corporate junk bonds. I like those, but I own enough of them for now.

Also discussed in the investment committee meeting:

- I have a growing affinity for holding the stocks of financial services companies.

- I’ve flattened out a relatively heavy weighting of technology throughout the last 10 months. I am more likely to continue that trend than to reverse it.

- For years I’ve avoided non-U.S. based investments; I continue to resist exposure to foreign stocks. It would not be unreasonable to consider owning international stocks for what could benefit from being more diversified portfolios. However, exposure to non-U.S. stocks has generally added volatility and dragged on returns. While I don’t regret that decision, the lack of diversification makes me nervous.

- Fortunately, I’ve mostly steered clear of mid-cap stocks, but I still have a relatively small allocation to small caps. The allocation is tiny enough that we aren’t planning to reduce it, but we don’t currently plan to add to it.

For now, folks, you know as much as I do. As always, I’ll keep you in the loop if I make any moves.

Allen Harris is the owner of Berkshire Money Management in Dalton, Massachusetts, managing investments of more than $700 million. Unless specifically identified as original research or data-gathering, some or all of the data cited is attributable to third-party sources. Unless stated otherwise, any mention of specific securities or investments is for illustrative purposes only. Adviser’s clients may or may not hold the securities discussed in their portfolios. Adviser makes no representations that any of the securities discussed have been or will be profitable. Full disclosures. Direct inquiries: [email protected].

This column appeared originally in The Berkshire Edge on February 28, 2022.

Allen is the CEO and Chief Investment Officer at Berkshire Money Management and the author of Don’t Run Out of Money in Retirement: How to Increase Income, Reduce Taxes, and Keep More of What is Yours. Over the years, he has helped hundreds of families achieve their “why” in good times and bad.

As a Certified Exit Planning Advisor, Certified Value Builder, Certified Value Growth Advisor, and Certified Business Valuation Specialist, Allen guides business owners through the process of growing and selling or transferring their established companies. Allen writes about business strategy in the Berkshire Eagle and at 10001hours.com.