American Values Impact Financial Choices | Conscience or Money?

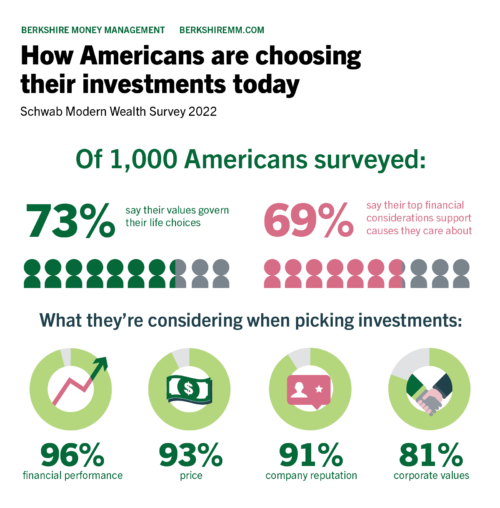

Charles Schwab’s sixth-annual Modern Wealth Survey revealed that people with money do have a heart. Almost three-quarters of the American respondents (73 percent) say that their values govern their life decisions. And almost as many (69 percent) say their top financial considerations support causes they care about. When deciding where to place investment dollars, Americans consider such things as the company’s reputation (91 percent). Corporate values (81 percent) are nearly as crucial as traditional factors. The company’s financial performance (96 percent) and the price (93 percent) still mattered the most, but barely.

These values carry over to the workplace. More than 8 in 10 (84 percent) say their values guide their employment decisions. Nearly 6 in 10 (59 percent) would accept a lower salary to work for a company that better reflects their conscience.

What does money mean to you?

The Schwab survey showed that, to Americans, money means freedom (42 percent), flexibility (23 percent), and opportunity (18 percent).

I am happy to see that Americans with money continue to be philanthropic. They can be. They should be. The global average annual salary is just under $18,000 per year. A heuristic for being able to retire comfortably is to do so with 10 times your salary. Globally, that means people, on average, would feel “financially comfortable” (as the study calls it) retiring with $180,000. (Although, let’s face it, there’s not a lot of room to save with such a low income.)

Are you financially comfortable?

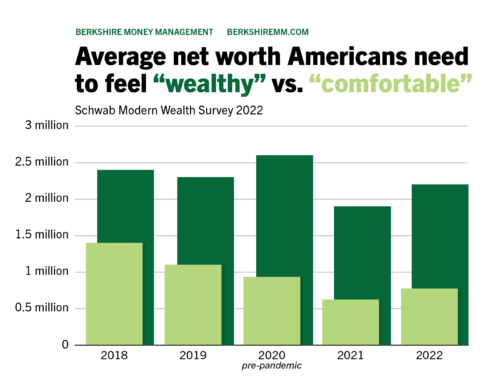

The median family income in the U.S. in 2021 was $79,900. Ten times that amount is $799,000. As if on cue, the respondents to the survey say they need $774,000 to feel financially comfortable.

To feel “wealthy” in 2022, Americans need $2.2 million. The numbers to feel wealthy and financially comfortable are up from 2021 but down compared to before the pandemic. Since the last Capital Ideas column, the rich got richer.

There’s more to explore in the complete report on Schwab’s website.

Allen first reported on the results of the 2022 Modern Wealth Survey in The Berkshire Edge on June 6, 2022.

Allen is the CEO and Chief Investment Officer at Berkshire Money Management and the author of Don’t Run Out of Money in Retirement: How to Increase Income, Reduce Taxes, and Keep More of What is Yours. Over the years, he has helped hundreds of families achieve their “why” in good times and bad.

As a Certified Exit Planning Advisor, Certified Value Builder, Certified Value Growth Advisor, and Certified Business Valuation Specialist, Allen guides business owners through the process of growing and selling or transferring their established companies. Allen writes about business strategy in the Berkshire Eagle and at 10001hours.com.