Is the bounce legit?

Anything can happen between when I write this column and when it gets published. As of the moment my fingertips are tapping the keyboard (December 7, 2021), the major U.S. averages are roaring up. But is the bounce legit?

The good news about the timeliness of this column is that this is a question that can apply to today, the 7th, and any bounce that may occur throughout the next month.

But before we attempt to answer that question, today’s column was brought to you by the Federal Reserve’s semi-annual Financial Stability Report. According to the report, U.S. households have a growing risk appetite for stock market participation. The report, which has some severely lagging data, cites that household ownership of stock ownership is cyclical. “Over the past three decades, a survey-based measure of the share of households reportedly willing to take financial risks reached a peak in 2001, hit a trough in 2009, and then rebounded notably. By 2019, the most recent survey, it was again approaching its 2001 peak.”

In 2001, stock ownership was high. The stock market had been roaring for years as the Technology Bubble inflated … then the stock market collapsed.

In 2009, stock ownership was low. The stock market was devastated after the Financial Crisis … then the stock market roared.

In 2019, stock ownership was high. I had been calling for a recession-induced stock market crash; COVID-19 happened before my hypothesis had a chance to prove itself.

Somewhere between 2019 and today, stock ownership dropped as investors bailed out of the markets during the COVID Crash.

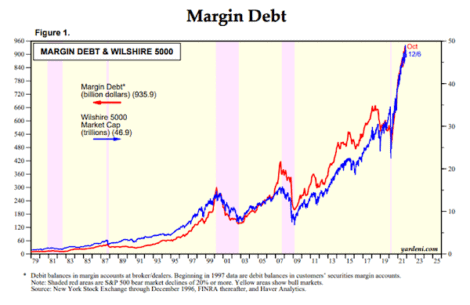

In 2021, stock ownership is en vogue again. According to Yardeni Research, Inc., margin debt is higher now than it was pre-pandemic.

Margin debt is the debt a brokerage customer takes on by trading on margin — the investor is taking a loan to buy stocks. When the price of the margined stock goes down, the stock is “called.” If you are margin-called, you must come up with the cash to cover it or sell stocks to raise cash. If you’re paying interest on the money used to buy stocks, you probably don’t have a lot of cash in reserve. Well, guess what? Margin calls typically trigger sales, which lowers prices, and begets more selling. A stock market correction in a highly levered market can feed upon itself. With that context, we must ask, is the bounce legit?

On the one hand, I remember then-Federal Reserve Chairman Alan Greenspan’s description of the stock market in 1996. He famously stated that the stock market was exhibiting “irrational exuberance.” Despite what some would describe as overly optimistic stock prices, the markets had a good 1997. And a good 1998. And a good 1999.

When things are good, I remember that they can remain good. For some, that may seem obvious. However, it appears that there is often no wisdom in crowds, as the Fed’s Financial Stability Report pointed out. Not everyone can be as astute an investor as infamous golfer Al Czervik, who boldly stated: “Oh, everyone is buying? Then sell, sell, sell!”

Al advised selling on July 25, 1980, as if prognosticating the coming recession. Al was a few months early, but selling would have side-stepped a peak-to-trough decline of about 25 percent in the S&P 500 because he got out when everyone was buying, and optimism was high.

But, I suppose even Al would have been wrong if he sold stocks in 1996, at what had seemed to be the height of investor exuberance – at least to Dr. Greenspan. However, it turned out that 1996 was the start of an enormous productivity revolution, ushered in by widespread use of the World Wide Web.

Investors today want to suggest that blockchain technology is the new World Wide Web, which should justify ever-higher stock valuations. Sure, blockchain has potential uses, such as payment processing, identifying NFTs (non-fungible tokens), and record filing. However, I would argue that the benefits of blockchain are not comparable to what the Web has provided us: email, video conferencing, SaaS (software as a service), and, well, pretty much putting the answer to every question (except for the meaning of life) at our fingertips.

In other words, as optimistic as the investing world is today, I don’t see how the major U.S. equity averages can keep pumping out 20-percentish returns year over year. Something’s gotta give. Valuations are elevated. Earnings growth is losing steam. Equities are threatened by the prospect of rising interest rates. That doesn’t mean the death of equities, but it does point to moderating U.S. equity returns in 2022, with more frequent pullbacks.

We are entering 2022 with a pretty solid foundation. The third-quarter 2021 earnings season is nearly complete, with more than 95 percent of S&P 500 companies having reported. Third-quarter year-over-year (YoY) earnings growth is tracking at a bit more than 40 percent on the back of nearly 15 percent revenue growth. That compares to YoY earnings and revenue growth of 108 percent and 22 percent, respectively, in the second quarter of 2021. The big takeaway for the third quarter of 2021 was how well overall corporate margins held up despite rising cost pressures in the form of accelerating wages, higher shipping costs, and elevated raw materials prices. The net earnings margin for Q3 2021 was 12.8 percent — up from 12.7 percent in Q2 2021 and 10.4 percent YoY.

The resilient margin performance of S&P 500 companies reinforces that corporations are learning to navigate supply-chain issues, as well as labor and material shortages. So, yeah, I’m not yet ready to call the death of equities yet. But I wouldn’t be surprised if the recent 5 percent stock market pullback doubled or tripled in size before stock prices regained traction.

It is difficult – nay, impossible – to gauge the magnitude and timing of these things. I try to focus my attention on whether these things might happen quickly and rebound or if they could grind on for a long time at a pace we can side-step. Those grinds are typically associated with economic recessions. And I do think you can call recessions, so long as you don’t get all wrapped up in the prevailing good news and ignore the creeping negative signs.

It’s clear to me that the U.S. economic growth will slow, but that doesn’t mean recession – just potential equity challenges. (The stock market cares less about the level and more about the direction, including second-derivative metrics.)

That’s not unlike what’s happening with the stock market currently. I see a moderation – possibly a disruption – for stock prices, but not a crash. After about a 5 percent correction in the S&P 500, the stock market was short-term oversold. A rally may resolve the carnage occurring beneath the surface of a slight pullback. Yeah, I said it. The stock market level looks fine, but there’s some scary stuff happening that you wouldn’t see without some serious inspection. If the stock market internals improve with a rally, maybe we put off that 10-15 percent pullback until some other time. But I’m betting the stock market got about halfway through something more considerable.

The percent of NYSE-traded companies trading within 10 percent of their 52-week high dropped to 26.34 percent on December 1, 2021, its lowest level since November 2, 2020. Outside of corrections and bear markets, readings like this are very rare. They are exceptionally scarce this close to a market high. On December 1, 2021, the percent of those companies hitting new 52-week lows was 9.83 percent. Throughout the previous two years, higher readings can only be found during the 2020 Covid Crash. The relatively small pullback of the S&P 500 stock market is deceiving investors. It’s a cautionary sign.

The day after Thanksgiving, November 26, 2021, the stock market acted like a real turkey and got walloped. The trading day registered as a 90 percent Down Day (90 percent of all points and volume of companies trading on the NYSE were down). Ideally, the market would have bounced the next day with a 90 percent Up Day, signaling stocks had gone down low enough in price that intense liquidation had been replaced by enthusiastic buying.

There is still a chance for that, but the further away we get from the 90% Down Day date, the less likely that rush of buying is expected to occur. The threat is that a 90 percent Down Day without a follow-through 90 percent Up Day (or two back-to-back 80 percent Up Days) needs lower prices to bring in that enthusiastic buying. Without that follow-through demand, it wouldn’t be unusual to expect one or more additional 90 percent Down Days throughout the subsequent thirty trading sessions (or mid-January). It’s possible that the stock market will want to adjust to the concerns of moderating growth and higher interest rates during the next month.

I’m not overly concerned about it. If you’re sitting on a bunch of cash, you might want to consider using a 10-15 percent correction as an opportunity to invest in U.S equities. When others are selling, buy — at least if there is no recession on the horizon; I don’t believe there to be. 2022 may not be as good for the market as the last couple of years, but given persistent inflation and a nearly zero percent rate of return on your bank account, cash isn’t an attractive long-term asset class.

Allen Harris is the owner of Berkshire Money Management in Dalton, Mass., managing investments of more than $700 million. Unless specifically identified as original research or data-gathering, some or all of the data cited is attributable to third-party sources. Unless stated otherwise, any mention of specific securities or investments is for illustrative purposes only. Adviser’s clients may or may not hold the securities discussed in their portfolios. Adviser makes no representations that any of the securities discussed have been or will be profitable. Full disclosures. Direct inquiries: [email protected].

This article originally appeared in The Berkshire Edge on December 13, 2021.

Allen is the CEO and Chief Investment Officer at Berkshire Money Management and the author of Don’t Run Out of Money in Retirement: How to Increase Income, Reduce Taxes, and Keep More of What is Yours. Over the years, he has helped hundreds of families achieve their “why” in good times and bad.

As a Certified Exit Planning Advisor, Certified Value Builder, Certified Value Growth Advisor, and Certified Business Valuation Specialist, Allen guides business owners through the process of growing and selling or transferring their established companies. Allen writes about business strategy in the Berkshire Eagle and at 10001hours.com.