Investing to Advance the World

Dalton, Mass. — Over the decades, I’ve gravitated toward investments that are classified as leaders in changing the world for the better in the realms of environmental, social and governance (ESG) concerns. While socially responsible investing fits my personality, the gravitation toward those investments hasn’t been conscious. I’ve merely been trying to find investments that best strike a balance between potential risks and rewards.

For example, the five largest positions of my company, Berkshire Money Management, are (by symbol) VIG, SPY, IWF, DIA and QQQ. Each of these has a Morgan Stanley Capital International ESG (Environmental, Social and Governance) Fund Rating of “A.” MSCI describes A-rated funds as “leaders” and explains that they are “exposed to companies that tend to show strong and/or improving management of financially relevant ESG issues. These companies may be more resilient to disruptions arising from ESG events.”

ESG investing has been considered a luxury that investors could afford during bull markets but could prove costly in a downturn. However, a Morningstar study concluded that there is “no evidence that investors need to sacrifice returns when they invest in good ESG companies globally compared with bad ESG stocks.” Morningstar’s “ESG Protect on the Downside” report found that 72 percent of Morningstar’s equity indices that use ESG screens lost less than the overall market during down periods for the five years through the end of 2019. Morningstar found that 80 percent of those ESG indices outperformed their broader market equivalents in the first quarter of 2020.

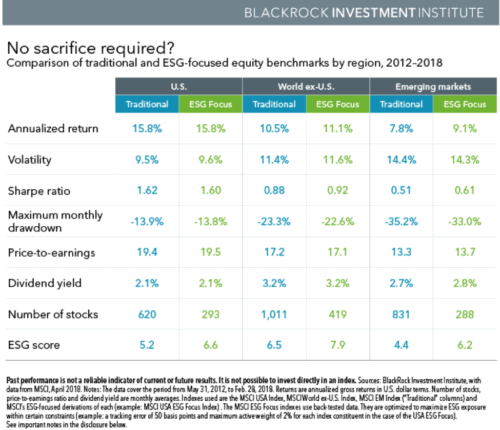

Furthermore, S&P Global Market Intelligence selected 17 of the largest ESG ETFs and mutual funds, and year-to-date through May 15, 2020, 83 percent of them outperformed the S&P 500. (Keep in mind that the S&P 500 corrected nearly 40 percent throughout that period, so that’s some serious battle-testing.) Black Rock has confirmed similar results, showing that there is little if no trade-off of either risk or reward for ESG-focused investments relative to more traditional equity benchmarks.

The thing is, when I bought those ETFs, I was merely trying to make money for my clients and myself. It turns out that households and other companies want to give their business to those trying to improve the world not just because it is important to their conscience, but because those companies are getting things done in terms of earnings and sales growth and providing relevant solutions. It turns out that, according to MSCI, “companies that fail to manage ESG risk have historically experienced higher costs of capital, more volatility, and accounting irregularities.” That gives an advantage to those who effectively manage ESG risks.

MSCI’s ESG ratings are a good starting point for socially responsible investing screening. It utilizes what’s referred to as negative screening. For example, a company might have a low ranking if it mismanages water resources, waste and emissions, or demonstrates lapses in safety or outright corruption. Negative screening helps weed out companies that do harm. But what about those that not only do no harm, but actively do good?

Companies that have a positive impact move their way up in my rankings. It is not just because it feels good. It’s potentially a prudent long-term investment. I am talking about companies and industries that invest in progress and recognize that solving the world’s biggest challenges can be financially rewarding. The companies that save the planet will be able to command high margins and get big sales.

There is no historical data to support this, but I believe that the capital reallocation to companies that emphasize sustainability will occur over the very long term.

I have my favorite investments that I buy if I sell something else. For example, deposited cash often finds its way to those five ETFs I mentioned earlier by symbol: VIG, SPY, IWF, DIA, and QQQ. While those investments are highly rated on the ESG scale, that wasn’t my intention; I just liked the investment.

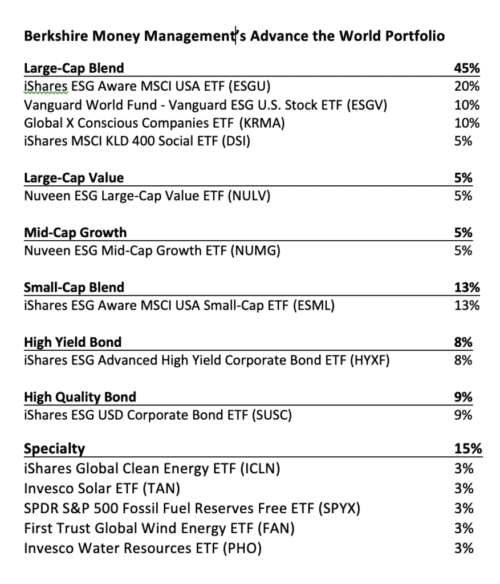

For some clients, there may be times when I need to get rid of those investments and the replacements may not be as highly related. Other clients may wish to stick with investments that more closely align with their ideology. So I created the Advance the World portfolio. The Advance the World portfolio emphasizes sustainable investing, which combines the best of what BMM does with, hopefully, value-added insights about what has impactful societal outcomes.

I want to share with you exactly what it looks like in case you want to get started on a long-term ESG portfolio of your own. (Check with your financial advisor to determine if it’s suitable for you. Read the prospectus before buying. You know the drill.)

Surveyed investors have reported that they are interested in incorporating socially responsible funds into their portfolios but didn’t know how to start — or if they should do so. I hope this helps you come to a conclusion on both of those challenging considerations.

This article originally appeared in The Berkshire Edge on December 7, 2020.

Allen Harris is the owner of Berkshire Money Management in Dalton, Massachusetts, managing investments of more than $500 million. Unless specifically identified as original research or data-gathering, some or all of the data cited is attributable to third-party sources. Full disclosures: https://berkshiremm.com/capital-ideas-disclosures/. Direct inquiries to aharris@berkshiremm.com.

Allen is the CEO and Chief Investment Officer at Berkshire Money Management and the author of Don’t Run Out of Money in Retirement: How to Increase Income, Reduce Taxes, and Keep More of What is Yours. Over the years, he has helped hundreds of families achieve their “why” in good times and bad.

As a Certified Exit Planning Advisor, Certified Value Builder, Certified Value Growth Advisor, and Certified Business Valuation Specialist, Allen guides business owners through the process of growing and selling or transferring their established companies. Allen writes about business strategy in the Berkshire Eagle and at 10001hours.com.