Here’s What Retirement Looks Like

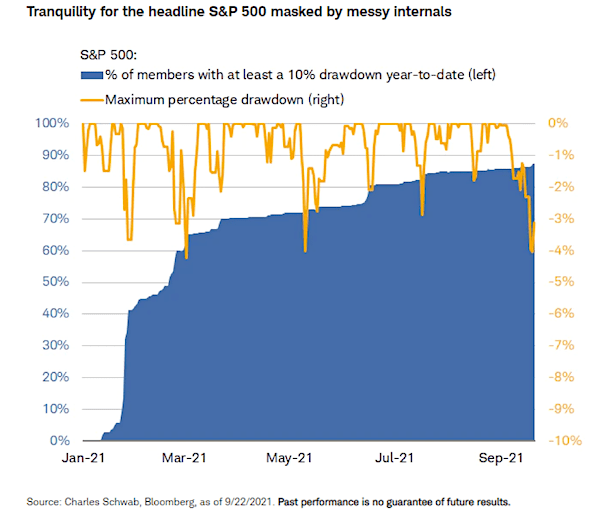

I went Halloween shopping last week, but I didn’t see anything scarier than the chart below (and I bought zombie babies, people).

The horizontal numbers on the right measure the drawdown of the S&P 500 year-to-date 2021, as graphically depicted by the yellow line. The horizontal numbers on the left show that nearly 90% of the indices’ members have already had at least a 10% correction year-to-date, as graphically depicted by the blue blob. The result is that it’s been a good year for you if you’ve held the S&P 500. However, because a substantial amount of the index’s underlying components have cracked more, we must remain vigilant in tracking when the stock market might break.

For now, the signs are ominous but not immediate. I bring this up because I’ve heard people suggest that investors immediately sell stocks in the Technology sector. The reasoning, in part, is emotional — people often sell stocks in response to their prices dropping. The more rational reason is that selling has occurred in the Technology sector because interest rates have drifted up. Specifically, the 10-year Treasury note hit a low of 1.18% on July 20, 2021, and has since risen higher than 1.5%. The textbook trade for rising rates has been to sell growth stocks, like those in the Technology sector, and buy stocks of companies in the Financial and Energy sectors.

I don’t often overweight the Energy sector by much. Energy comprises less than 3% of the S&P 500 and about 2% of the Dow Jones Industrial Average (DJIA), by market capitalization. I totally admit to my wimpiness in this regard. Suppose I bulked up my portfolio to triple the weighting of the broader averages. In that case, Energy stocks would still need a major return to generate enough alpha to be worth the risk. I may do so in the future, but I don’t try to be a hero with my money, so I don’t have that trade on my radar screen right now.

By the way, I admit that it was my mistake (if you want to call it a mistake) not to overweight Energy stocks in 2021. The sector has doubled the return of the S&P 500 year-to-date. If I had tripled the Energy allocation in my portfolio, that would have resulted in a bit more than one extra percent of return to my portfolio. Wait. What? Yup, that’s the math. Even when Energy stocks are ripping ahead of the general market, you need an outsized allocation to significantly affect your portfolio returns.

My wimpiness aside, the question remains: “Should we reduce our technology allocation if we expect interest rates to continue to rise?” To be nuanced, it matters why rates are rising, to what level they may rise, and how long will it take? Let’s speak generally. Rising interest rates are a sign of an economy whose growth is becoming more sustainable. Technology stocks often become more attractive when rates fall because that’s sometimes a sign of slowing economic growth. In response, investors are willing to pay a higher price to buy a company with its own non-correlated growth. Conversely, Technology stocks become less attractive when interest rates rise.

Readers may recall that on April 5, 2021, “in a few tiny spaces, I shifted some large-cap growth broadly and technology stocks specifically into large-cap value stocks. I also placed some of the proceeds into high-yielding corporate bonds (aka junk bonds).” However, that was not abandoning Technology stocks — that was reducing an already overweight exposure.

Although the popular trade is becoming to sell Technology stocks, I don’t intend to join the cool kids on this adventure. Energy stocks may continue to rip higher, and I’ll feel left out with my wimpy market weighting. However, I am hesitant to follow those selling Technology stocks. I tend to buy stocks through Exchange Traded Funds (ETFs) that carry a basket of stocks, including those in the Technology sector. By virtue of those companies making it into the indices tracked by the ETFs, I’d contend that they could be categorized as best-in-breed.

In addition to Financials and Energy stocks getting a lift from rising interest rates, Industrial stocks could benefit from massive infrastructure spending. There’s a lot of places to put your investment dollars. All I ask is that you don’t be too quick to sell off some of these best-in-breed Technology stocks that may be in your portfolio. People aren’t going to stop using Microsoft products, ditch their Salesforce CRM, hang up on their Apple phones or stop buying the products requiring Intel semiconductor chips. The stocks of these companies go down quickly at times, but I don’t suspect they’ll stay down easily.

By the way, gents, I wrote this column for you. According to recent research from the Massachusetts Institute of Technology, panic selling during stock market dips is a problem for men over age 45, married with children. Want to know what’s super-interesting about this study? The same group of guys selling stocks at the likely wrong time has self-described “excellent investment experience.”

This study is corroborated by a study from Fidelity, which cites that men are 35% more likely to trade investments than women, and that trying to time the market leads to lower performance. Guys might say that they’re just trying to create some stability during volatile periods. However, another study from British Columbia finds that the traders typically achieve opposite results.

As I pointed out in my book, “Build It, Sell It, Profit: Taking Care of Business Today to Get Top Dollar When You Retire,” “it’s not the fault of the individual investor. The amygdala, a section of the brain that is responsible for detecting fear and preparing for emergency events, overrides the rational prefrontal cortex and pushes humans to sell when stock prices go up down, in an effort to sell self-preservation. If you’ve ever sold a stock because its dropping price scared you, you are not weak. Rather, your brain is acting just as it is designed to.”

The best way to correct a character flaw is to first be self-aware. Denial doesn’t let you become self-aware, which is why I am piling evidence upon those with self-described “excellent investment experience” who sell when stocks go down. I can’t say you’re wrong to do so — on a human level. But being human doesn’t translate to being an excellent investor. I apologize if that sounds like a lecture — I just want to be helpful. Sometimes, a lesson can sound like a lecture.

Let’s take a peek at your retirement.

After perusing through a May 2020 survey from TransAmerica, I thought the findings might feel relevant to you because some of the views of your colleagues may be similar to yours. According to the report:

- 7 in 10 are saving for retirement. Millennials (72%) and Generation X (74%) are somewhat more likely than Baby Boomers (70%) to be saving for retirement.

- Retirement savings outside company retirement plans tend to increase with age. Twice the amount of Baby Boomers (44%) invest outside the workplace compared to Millennials (22%).

- 7 in 10 are looking forward to retirement. Eighty-seven percent of workers cite positive word associations with “retirement.”

- The most frequently cited retirement fear are outliving investments (40%), a reduction of Social Security (39%), declining health that requires the cost of long-term care (34%), and not being able to meet the family’s basic needs (32%).

- Sixty percent of workers believe they are building a large enough retirement portfolio.

- Forty-four percent of workers who estimated their retirement savings needs admitted that they guessed at what they need.

- Only 24% of workers have a written financial plan. Forty-one percent of workers use a professional financial advisor.

- Among workers who are married or living with a partner, only 67% said they are familiar with their partner’s savings. (Allen’s note: Let’s face it – the majority of those not familiar with their partner’s savings are women because men are awful at sharing important information.) Just 20% of workers say they frequently discuss saving, investing, and planning for retirement with family and close friends.

- The most frequently cited retirement intentions are traveling (65%), spending more time with family and friends (57%), and pursuing hobbies (46%).

- Fifty-seven percent of workers plan to work after retiring (40% part-time, 17% full-time).

- Forty-five percent of workers envision the possibility of phasing into retirement by reducing the hours worked at their current employer.

I pulled out of the 141-page report many of the bullet points to give you some benchmark about how you may be doing in preparing for or enjoying your retirement. I want to highlight that those last few bullet points are what I want to be taken notice of. You may have had similar considerations and didn’t know that others did, too. Often, we don’t choose to act on certain choices because we didn’t even realize they were options. If you’re aware of your options, you can better plan for your retirement or make modifications if you are already there. It turns out that many workers (40%) want to “keep my brain alert” and find that working gives them a “sense of purpose” (34%). If that describes you, you can be more aware of your options.

Allen Harris is the owner of Berkshire Money Management in Dalton, Mass., managing investments of more than $700 million. Unless specifically identified as original research or data-gathering, some or all of the data cited is attributable to third-party sources. Unless stated otherwise, any mention of specific securities or investments is for illustrative purposes only. Adviser’s clients may or may not hold the securities discussed in their portfolios. Adviser makes no representations that any of the securities discussed have been or will be profitable. Full disclosures. Direct inquiries: aharris@berkshiremm.com.

Allen is the CEO and Chief Investment Officer at Berkshire Money Management and the author of Don’t Run Out of Money in Retirement: How to Increase Income, Reduce Taxes, and Keep More of What is Yours. Over the years, he has helped hundreds of families achieve their “why” in good times and bad.

As a Certified Exit Planning Advisor, Certified Value Builder, Certified Value Growth Advisor, and Certified Business Valuation Specialist, Allen guides business owners through the process of growing and selling or transferring their established companies. Allen writes about business strategy in the Berkshire Eagle and at 10001hours.com.