Berkshire Business Confidence Index, Issue 7

Winter 2019 Results from the Berkshire Business Confidence Index

The Berkshire Business Confidence Index (BCI), sponsored and analyzed by Berkshire Money Management, indicates that there is a high level of optimism among Berkshire County businesses, as well as non-profit organizations that are responsible for business decisions. We mailed out 4,000 surveys countywide, and received responses from the full spectrum of Berkshire industries—non-profits, retail, manufacturing, finance, lodging, real estate, construction, and more. Each brings their own voice to this survey.

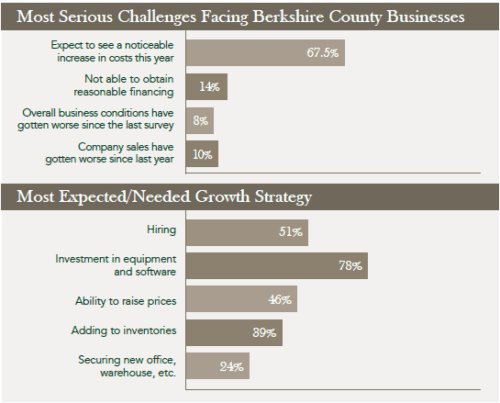

What we have gleaned from this quarter’s results:

• From the last survey (Summer 2018) to this survey, overall confidence was up slightly, from 58.6 to 60.3 (after having dipped in Spring 2018).

• Notable improvements in the view of overall conditions have prompted businesses’ intent to invest in new office space in the Berkshires. Also, businesses have had success raising their prices to match increasing operating costs, thus protecting profits.

• In the last survey there was one negative component to the BCI— increased costs. Last quarter, costs had the dubious distinction of being the only component to drop (in confidence), but also the sole negative component (as it is in this survey). This quarter, four individual components of the index dropped, the biggest drop being access to financing on reasonable terms.

The ‘Numbers’

The Berkshire BCI for this survey period is 60.3, up slightly from the last survey’s 58.6, signaling continued optimism among Berkshire County businesses and organization leaders. A reading of greater than 50 signals increased economic activity. Less than 50 indicates a contraction in activity, and 50 corresponds to no change. Over time, as we continue reading and analyzing the surveys, the trend of that statistic will be important in determining the direction of confidence. Today, county businesses have mixed feelings, but are generally more optimistic. Let’s look more closely at the areas in which we collectively see opportunities or challenges by addressing some of the survey questions individually.

The Questions

How have overall business conditions changed since the last time you responded to this survey?

With a score of 59.21, 43% of respondents saw an improvement. This is an assessment that economists refer to as “coincident conditions”, a measure of what’s happening now. Granted, it’s a snapshot of history, but only of fairly recent history. It’s used to determine a trend, and the trend has been stable throughout the last two years – mostly modest improvement quarter-over-quarter for Berkshire businesses.

How do you expect overall business conditions in the Berkshires to change over the next 6 months?

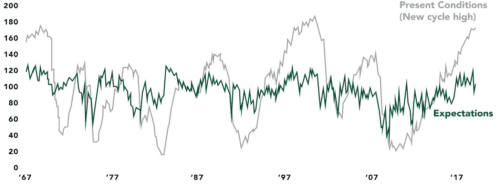

With a score of 63.51, 51% of respondents expect an improvement. One of our greatest predictors of US recessions is to compare consumer surveys that track present conditions relative to expected conditions. Historically, as expected conditions turn down for a sustained period while present conditions continue to hold strong, a recession is very likely to occur approximately 1-2 years later. This happened on a national basis in October, and, if it doesn’t recover, signals a recession. In the chart below, the grey horizontal bars denote US recessions. More locally, the expectations component outpaced the coincident number 63.51 to 59.21. The Berkshires are not insulated from recessions, but that comparison ratio currently shows more business strength locally than the nation aggregately.

Consumer Confidence: Present Conditions vs Expectations

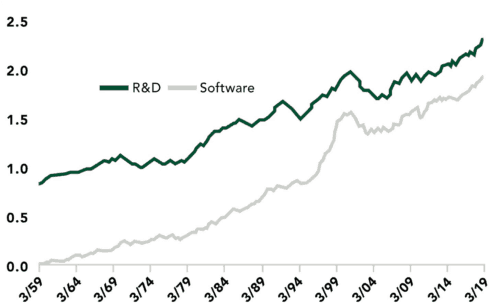

Is your company or organization investing in new equipment and software?

Coming in at 72.97, this has consistently been the second highest contributing component to the BCI, second only to access to reasonable financing. But not this time. Up 3.5 points to 72.97, a rise of five percent, it was the most positively skewed question. This mirrors what we’re seeing nationally. In the most recent release of US Gross Domestic Product (GDP), the numbers reveal that intangibles such as research and development and software have been surging as a share of GDP (see chart below). In fact, both are at record levels relative to output nationally. Berkshire business owners are seeing the value and return on investment of that national trend.

The Intangible Economy: Investment in Software + R&D Surges

How easy is it for your company to obtain financing on reasonable terms?

This component is down 8 points. You might wonder if the emphasis was on the ability to “obtain” financing, or if the emphasis was on the “reasonableness” of terms. It’s a difference, but in terms of expansion there’s not much difference. If you cannot obtain any financing through traditional lenders, you may accept unreasonable terms from shadow lenders. There may be an emotional component to the answers. Consider that in the stock market, prices don’t move based on “good” or “bad”. They move based on “better” or “worse”. Interest rates are still at historic lows (good), but they are higher since the last survey (worse). It’s possible that respondents voted on recent comparisons and may not have felt that higher rates were justified.

Is your company or organization hiring?

The intention to hire rose 2.5 points to 61.5. That is still above 50, which indicates growth. The number of respondents with modest-to-substantial hiring plans leaped from 27% to 51% as many businesses altered their answers from the last survey from “no change” in their employment levels to an intention of “modest hiring”.

Did the government shutdown affect your business?

89% said no. 9% said yes. The respondents who were affected did business with governmental regulatory bodies that they did not have access to during the shutdown.

Do you expect a recession by 2020?

37% said yes; 53% said no. (Note: This does not equal 100% due to “other” answers). A study released on February 25th by the National Association of Business Economists revealed that 10% of economists expect a recession in 2019, 42% expect a recession in 2020, and 25% expect a recession in 2021. The remainder had no opinion, no idea, or said no. The fact that fewer Berkshire County business owners expect a recession by 2020 than the 300 surveyed economists (37% vs. 52%) is consistent with our earlier current conditions and expected conditions comparison.

Why the Berkshire BCI?

We need to leverage the advantages other business managers see, and also to learn from their mistakes. We do not suggest that we “do this as a community”. Decision makers need to do it for themselves and for their businesses. Your job isn’t to negotiate utility costs for your municipality, or to build a university to create a skilled labor workforce. You must contend with market, or systemic risk.

Your job is to handle the challenges of unsystematic risk specific to your business, whether that is to decide on the best recruiting methods to build and sustain a reliable workforce, or to deliver a new service/product line to keep up with a changing marketplace. The main mission of the Berkshire BCI is to give you the information you need to make business decisions confidently and to provide potential choices, thus creating the opportunity to make better, more informed decisions. The BCI can identify problems and then we, as a business community, can use each other as a resource. We are finding that area business owners want to share their good business ideas, and help others steer clear of mistakes. We see this dialogue as a tool for all of us to share collective information so as to more confidently make changes and add value to our businesses.

The Bottom Line

One month after having suffered through a stock market decline that priced in a 2019-2020 recession, area business owners are rather optimistic, especially compared to national numbers. For comparison, consider that while the NFIB (National Federation of Independent Businesses) Small Business Optimism Index is still well above its historical average, it did slip in January to its lowest levels since the weeks before the November 2016 elections. It’s possible that another month’s worth of data would have strengthened the NFIB number, but even if it had remained unchanged, as opposed to slipping, the narrative wouldn’t have changed much. National business optimism has been declining overall.

One thing our local business owners have in common with national business owners is that there remains a continued appetite for hiring as well as investing in technology. The BCI survey saw continued high numbers and increased intent for hiring and investing in technology. The two go hand-in-hand. The labor market is incredibly tight and each new employee brings a diminishing level of new capacity. The proper implementation of technology, however, can leverage labor’s capacity more than a new hire.

Via our survey along with dozens of conversations with other business owners, I understand how difficult it is to find and hire qualified workers. To that end, the BCI is helping with that conversation. On April 11th at 3:30pm at the Berkshire Money Management offices, in association with the Associated Industries of Massachusetts, we are going to have a roundtable discussion titled “Finders Keepers: Hiring and Retaining Skilled Employees”. An emphasis on “skilled”. If you’d like to attend, e-mail me at AHarris@BerkshireMM.com and I’ll send you a registration link.

We’re pleased that fewer local business owners expect a recession by 2020 than national business economists. As more than a couple local business owners mentioned in the survey, people are notoriously bad at forecasting such things. I can’t argue that. Yet, it seems to be my main job. My most important job is determining whether a stock market decline is associated with a recession (because those are the worst and require the most defensive positions). I’ve been vocal about expecting a recession by 2020 and wanted to get a more official view of the local landscape beyond shop talk during non-business dinners.

If I’m wrong, well, that makes my investment job easier. Also if I’m wrong, then for you and me as business owners, we don’t have a lot to lose. Tightening the corporate belt can be a slow

Belt tightening, and increasing profitability, seems like much better of a choice than the top two alternatives that respondents said they’d use to reduce costs during the next recession: cutting their own salary and/or laying off employees.

Penetrate Your Existing Market By Adding New Services

When you think about how to grow your business, you likely first think about getting

However, an assessment of where you are weak relative to your peers may give you a simple solution. From there, the implementation is more operational than creative. Whether your new service (or product) is playing catch up to the industry, or is something brand new, two of the next steps are to “ask everybody” and then “tell everybody”. Start with a survey of your current customers. You can use Google Forms, or Survey Monkey, or Qualtrics or about a half dozen other software tools to engage with your people. Find out what they like, and what they don’t like about you. Ask about their interaction with competitors and what they do that you don’t. Most importantly, ask questions about their spending habits. See where your customers are already spending their money. These are people who know you and trust you. If you can reveal a trend of where your ideal clients are spending money you’ll be able to make an obvious connection to which new potential service lines are the most complementary. And not just complementary in terms of it makes sense, for example, that if you sell paper maybe you start also selling staples. I am referring to operational complements that allow you to roll out a service with minimal capacity strain and minimal investment risk.

It’s interesting when we have conversations with business owners and their C-Level management team. The owner, if they are a visionary and play the role of CEO, gets the concepts and once they discover the next service line, give marching orders to their team. The more detailed conversations occur with the operations teams, relating to rolling out the product line.

Most people don’t want to accept that there is a simple solution to a complex problem, but there usually is an easy answer. Your subconscious drives you away from an opportunity because it’s perceived as a difficult problem that must only be able to be solved with a difficult answer. But it’s really not that hard.

The specifics for each company will vary, but there are some guidelines to follow. If the new service or product is going to be part of a client segmentation plan, you want to give your current customers enough notice if it is going to affect them. Generally, people resist change, then succumb to it (usually forgetting the mental pain of the change and ending up in a position where they can’t imagine going back to “the old way”). Whether it’s for current clients or new clients, enthusiasm and communication go a long way. You will want to convey to your client and, very importantly, to your team what this will do for customers. Will it allow you to deliver more value to more people? Will it reduce their waiting time, or make their results better?

Of course that is necessary from the sales aspect, but that information is also required to promote enthusiasm across your entire company. When your people know why you are doing something they are willing to accept what initially might feel like a Hecrulean feat (if only because people don’t like change). You will want as much help as you can, and having positive morale and open communication will go a long way.

Then, set 90-day sprints. Set goals and revenue projections for the appropriate timetable (one year out, for example), but set the first goals to be what I refer to as “achievables”. New shorter-term goals should be set to move you closer to your longer-term goals, and those shorter-term goals should be “achievable” and specific persons should be held accountable. Not only do you start with positive momentum, but you get to encourage your people by celebrating wins.

You can’t do a good job getting into specifics in an article that is intended to be read by 4,000 people. And I realize that without specifics you may still be left thinking that the solution needs to be complicated. It doesn’t. Start by having a lunch with your management team, brainstorming what new service or product might be good for your clients, and what that ideally would look like two years from now. If you are enthusiastic about what that means for your clients and your business, take the idea to your clients to gauge the potential buy-in. You’ll be surprised how easy it will be to grow your business by doing even more great things for your clients.