Student Debt Relief Plan: What you need to know

President Biden and the U.S. Department of Education announced a plan on Wednesday, August 24, to provide further assistance to federal student loan borrowers. If you have private loans only, unfortunately this won’t apply to you. But this is an exciting announcement for millions of borrowers with federal student loans.

Long story short, if you have a Federal loan, take a moment to review your options (more on that below). It is also important to note that President Biden does not want to stop here. He hopes to make further changes that will make college more affordable for the next generation.

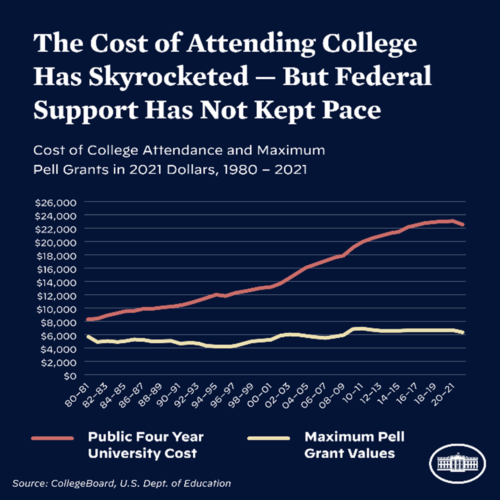

Looking at the cost of college over time, it’s clear there has been a dramatic increase over the years. However, federal student aid has not seen anywhere near that same jump. This means that if someone wants a college degree, there is a very high change they’ll need to take out loans to afford it.

How Biden hopes to help here is by increasing the maximum amount of federal aid an individual can receive. He also hopes to put policies in place that will better regulate the cost of a college education and make it so those who cannot afford an education will have reasonable means to get there.

That’s the hope for the future. Here’s what’s happening right now.

Key points of the Student Debt Relief plan announced this week:

- The loan repayment pause has been extended to December 31, 2022, meaning your next payment will be due in January 2023.

- What do I need to do?

Nothing! This will occur automatically.

- What do I need to do?

- Debt cancellation up to $20,000 for those below certain income thresholds ($125,000 for individuals; $250,000 for married couples)

- Up to $10,000 in relief for federal loan holders

- Up to $20,000 in relief for federal loan holders who received Pell grants

- The amount canceled cannot exceed your total outstanding debt (i.e., if you qualify for up to $20,000 in relief, but only have $10,000 in loans, you will have $10,000 canceled with no further refund)

- What do I need to do?

This may be automatic if the Department of Education already has your income information. Otherwise, you’ll need to submit a simple application (which is not yet available)Sign up for email notifications here to be alerted when the form is available.

- What do I need to do?

- Proposal for a new Income-Driven Repayment Plan

As a federal student loan borrower, you may be able to enroll in an Income-Driven Repayment plan, allowing you to make monthly payments in proportion to your income as opposed to the standard 10-year schedule. The administration is proposing changes to make this more favorable for low- and middle-income Americans:- Reduced percentage of your income going towards loan payments, resulting in lower monthly payments (as low as $0)

- Any unpaid interest to be paid by the government, meaning the total loan balance will not grow due to unpaid interest (for example, if your monthly payment is $0)

- What do I need to do?

Stay tuned for more information!

- What do I need to do?

Wednesday’s announcement crashed the federal student aid website, but information about the debt relief plan is available for review online: https://studentaid.gov/debt-relief-announcement/

It’s easy to take out a student loan, but it’s hard to earn a degree. And even harder to draw up a plan as to how to make a living with that degree. It’s important to me that I mention college is not the right path for everybody. But those who choose to continue their education should have an equitable opportunity to seek it out. Hopefully these changes will be meaningful, not only to current loan holders but for the future generation thinking about how they can make college ‘work’ for them.

As part of our college planning process, we help families to save for school and to save on the cost of tuition. If you’re thinking about college, we can help.

Lauren Russo, CVB, CEPA, is a financial advisor at Berkshire Money Management.

Lauren is a CERTIFIED FINANCIAL PLANNER™ professional, Certified Exit Planning Advisor, and Certified Value Builder. In her role as Assistant Director of Financial Planning at Berkshire Money Management, she develops comprehensive financial plans for BMM clients and prepares business owners to strategically transfer or sell their companies.