Berkshire Business Confidence Index, Issue 8

SUMMER 2019 RESULTS FROM THE BERKSHIRE BUSINESS CONFIDENCE INDEX

SPONSORED BY BERKSHIRE MONEY MANAGEMENT AND 10,001 HOURS.

The Berkshire Business Confidence Index (BCI), sponsored and analyzed by Berkshire Money Management, indicates that there is a high level of optimism among Berkshire County businesses, as well as non-profit organizations that are responsible for business decisions. We mailed out 4,000 surveys countywide and received responses from the full spectrum of Berkshire industries, such as hospitality, manufacturing, retail, finance, real estate, and construction. Each brings their own voice to this survey.

WHAT WE HAVE GLEANED FROM THIS QUARTER’S RESULTS:

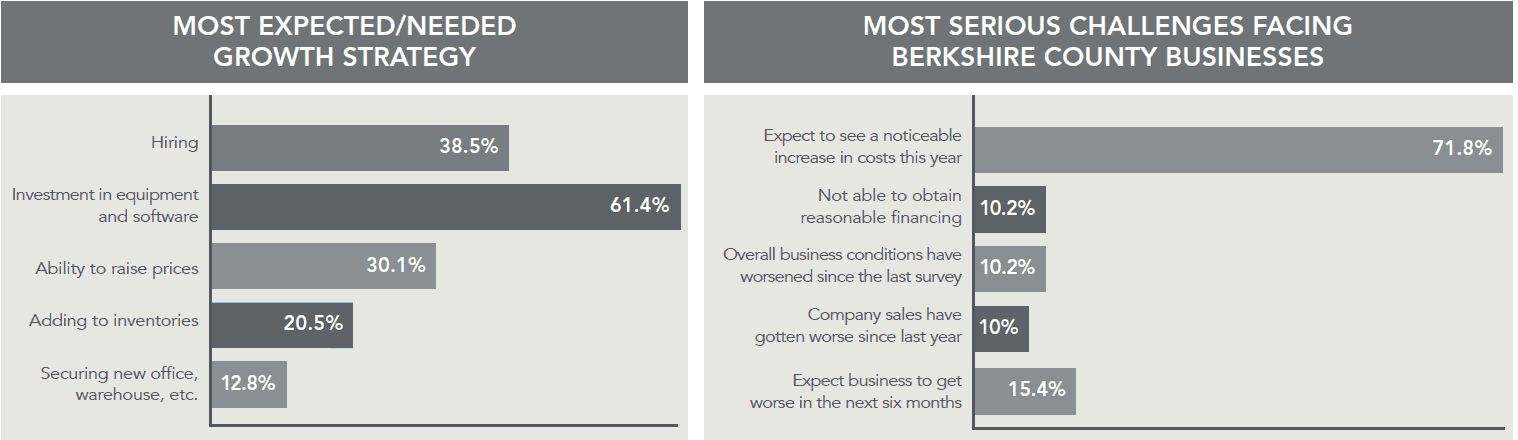

• From the last survey (Winter 2019; March 13th) to this survey, overall confidence was down, from 60.30 to 57.97.

• Businesses continue have abundant access to financing and are deploying capital to hire more employees and invest in new equipment and software.

• In the previous survey, four individual components of the index dropped, the biggest drop being access to financing on reasonable terms (which bounced back this survey). In this survey, seven individual components dropped, with the largest being that respondents expect business conditions to worsen in the Berkshires over the next six months.

• Nine of the ten individual components contributed positively, despite some of their survey-over-survey declines. The only component with a listing below 50, signaling contraction, is that companies continue to expect cost increases.

THE ‘NUMBERS’

The Berkshire BCI for this survey period is 57.97, down from the last survey’s 60.30, signaling continued optimism among Berkshire County businesses and organization leaders. A reading of greater than 50 signals increased economic activity. Less than 50 indicates a contraction in activity, and 50 corresponds to no change. Over time, as we continue reading and analyzing the surveys, the trend of that statistic will be important in determining the direction of confidence. Today, county businesses have mixed feelings, but are generally optimistic. Let’s look more closely at the areas in which we collectively see opportunities or challenges by addressing some of the survey questions individually.

THE QUESTIONS

HAVE OVERALL BUSINESS CONDITIONS CHANGED SINCE THE LAST TIME YOU RESPONDED TO THIS SURVEY?

The response to this question was the closest to unchanged, rising slightly from 59.21 to 59.87. With a score of 59.21, 43% of respondents saw an improvement. This is an assessment that economists refer to as “coincident conditions,” a measure of what’s happening now. Granted, it’s a snapshot of history, but only of fairly recent history. It’s used to determine a trend, and the trend has been stable throughout the last two years—mostly modest improvement quarter-over-quarter for Berkshire businesses. Nearly half, 41% of respondents reported no change. Only one, a cannabis dispensary, reported substantial improvement.

HOW DO YOU EXPECT OVERALL BUSINESS CONDITIONS IN THE BERKSHIRES TO CHANGE OVER THE NEXT 6 MONTHS?

This question received the largest drop, falling 7.1 points from 63.51 to 56.41. Of those who had reported improvements in overall business conditions since the last survey, 61.1% expect the next six months to be as good or better. Of those who saw no change or a decline in overall business conditions since the last survey, 85% of them expect stagnation, or worse, over the next six months. Moods have changed over the past few months. In the last survey I noted that the Berkshires were seemingly bucking that national trend, which was (and remains) deteriorating expectations as present conditions remained stable. Present conditions both locally as well as nationally remain stable, but now the six-month forecast by Berkshire business owners has, apparently, caught up to the national concern that things are going to get worse.

WHY THE BERKSHIRE BCI?

We need to leverage the advantages other business managers see, and also to learn from their mistakes. We do not suggest that we “do this as a community.” Decision makers need to do it for themselves and for their businesses. Your job isn’t to negotiate utility costs for your municipality, or to build a university to create a skilled labor workforce. You must contend with market, or systemic risk.

Your job is to handle the challenges of unsystematic risk specific to your business, whether that is to decide on the best recruiting methods to build and sustain a reliable workforce, or to deliver a new service/product line to keep up with a changing marketplace. The main mission of the Berkshire BCI is to give you the information you need to make business decisions confidently and to provide potential choices, thus creating the opportunity to make better, more informed decisions. The BCI can identify problems and then we, as a business community, can use each other as a resource. We are finding that area businesses want to share their good business ideas, and help others steer clear of mistakes. We see this dialogue as a tool for all of us to share collective information so we can more confidently make changes and add value to our businesses.

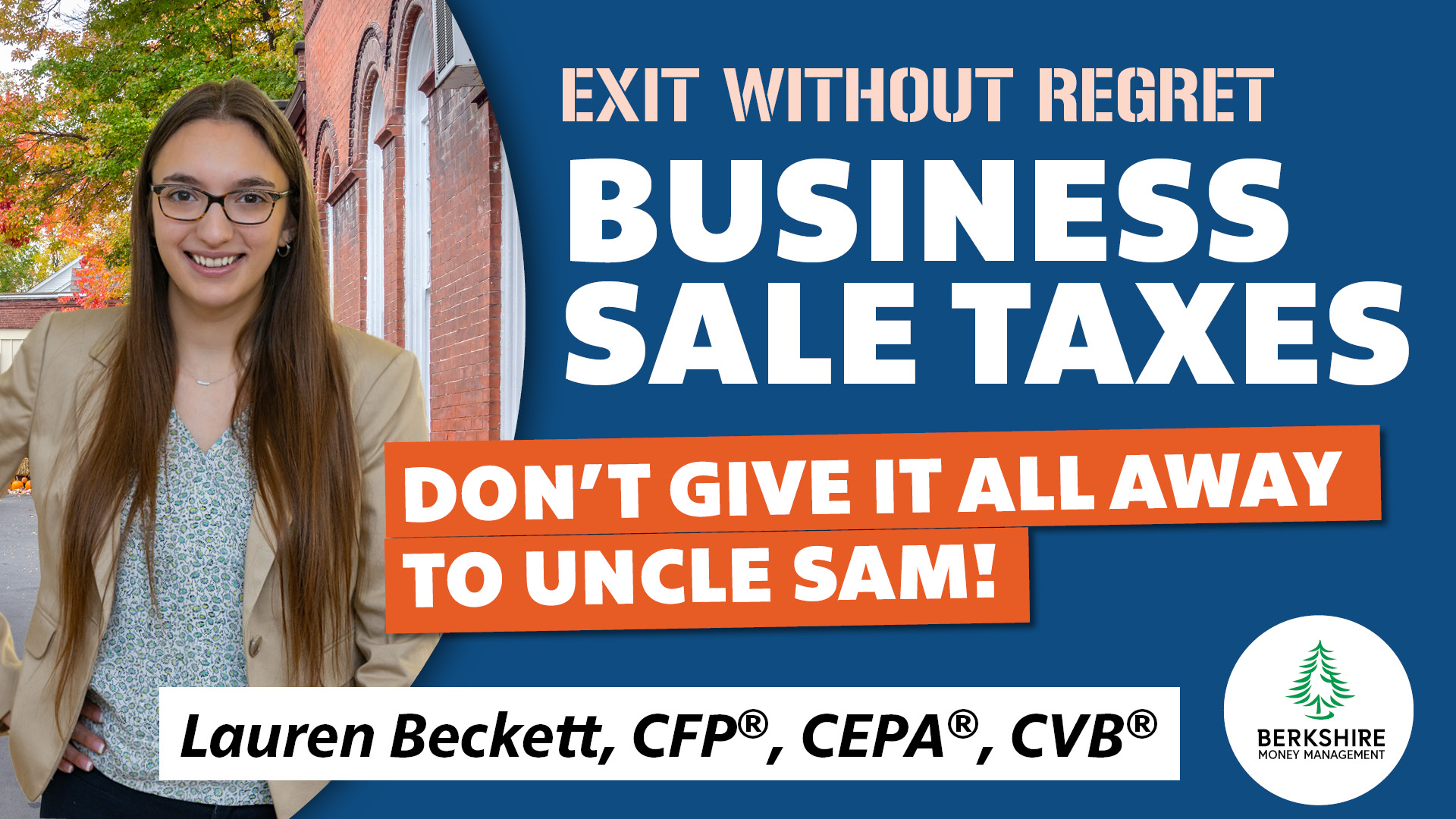

SELL, SELL, SELL!

SELL, SELL, SELL!

“For most business owners, the transfer of your business is a once-in-a-lifetime experience, and there is no do-over. It must be done right, with good decisions all along the way.” – Allen Harris, from the book, Build It, Sell It, Profit – Taking Care of Business Today to Get Top Dollar When You Retire.

In my book, Build It, Sell It, Profit, I explain the process of maximizing business growth, owner’s income, and corporate transferability so that when you decide to step away from your business you can get the best possible price for it. Stakeholders have been receptive to the advice and timeline of 3-5 years to truly get the best possible price. Still, some people decide to sell, as opposed to plan to sell. They’ve had enough and want out. This is a threat to a secure retirement because, well, think about it, if your job sucks so bad that you want out now instead of properly planning the sale, who the heck is going to want to buy it from you? And that’s why, in part, according to BizBuySell, an online business broker, only 20% of companies listed for sale actually sell—they don’t present the best version of themselves.

But this column isn’t for the people who like their jobs and aren’t ready to sell. This is for the people who are ready to get out and don’t want to put in the time to maximize a sales price. You are willing to pay a price in the form of money left on the table after a sale to get out of something you no longer enjoy. And for you, I have good news: It’s a great time for you to sell! According to recent data from BizBuySell, the second quarter of 2019 ranked as the most active for business sales over the last decade. There were 4,948 transactions in the first half of 2019. That’s the second most active business-for-sale market since it started tracking data in 2017. It’s second only to a very robust 2018.

The dip in 2019 relative to last year appears to be explained, in part, by political policies. In addressing the tariffs with China, 43% of small businesses say they are facing rising costs. Of those affected, 64% of owners say they are raising customer prices to offset those costs. For those businesses who have been affected by a new 25% Chinese tariff, 20% say they won’t be able to stay in business if the tariffs last for another year. Offsetting that potential aggregate economic weakness, according to the survey, 65% of owners are considering moving to suppliers outside of China. Of those considering, more than half are looking into bringing their purchasing back to U.S. suppliers.

Still, it remains a seller’s market. The economy is strong enough for companies to look more attractive to potential buyers, and potential buyers are motivated by your growth as well as their access to capital. Looking at numbers in the second quarter of 2019, compared to the same quarter of 2018, the median revenue of listed firms increased by 14.3%, with much of that attributed to the retail and service industries, where the median revenues rose 20% and 17%, respectively. The median cash flow increased 8.3%, led by service-oriented businesses, which increased 10%. All this has led to record high sales prices, increasing 13% from last year. This is especially rewarding for retirement-seeking baby boomers, who made up a large portion of the sellers and are now being well-rewarded for their efforts.

As owners and sellers negotiate a strategy to counter new costs, the negotiations take a bit longer (up 7% compared to last year), but the median amount of time a listing remains on the market was only 183 days (it’s closer to 200 days for companies with revenues over $1 million). Larger companies continue to command better pricing. The price-to-cash flow for businesses with revenues greater than $1 million was 3.61, compared to 2.37 for all businesses.

We partner with companies interested in maximizing business growth acceleration, particularly with owners who are looking to retire in the next 3-5 years. But if you just can’t bear to put in the time and effort to improve your businesses for an ideal transition, then now is a good time to sell. If not now, then when? The financial health of your for-sale business is going to provide plenty of incentive to prospective new owners. Sell now and get as good a price as possible in this business cycle. Just don’t make the mistake of having a realtor sell your business. Realtors sell property, not businesses. I can give you a couple of referrals if you want to sell correctly. The good news is that if you can sell your business now, you’ve timed it well. And if you can’t sell it in this market, then you know you will have to address some weaknesses and threats that are affecting your attractiveness.

JUST CHOOSE ALREADY! WHY QUICK DECISIONS MATTER

You want to grow your company. Business is good — but not good enough. It never is. You have bigger dreams. You want double-digit sales growth. Maybe you want to expand to a new market or launch a new product. Well, you can’t just snap your fingers and make it happen. It takes hard work, and someone has to decide what must be done. Every success you’ve had was because of a decision that was made. Every failure you’ve had was, hopefully, because of a decision you made. But, just as likely, your failures were due to a decision you didn’t make, or that got watered down and delayed from passing around the idea in too many meetings.

The pace of good decision making drives your business to higher levels. A good decision executed quickly beats a brilliant decision implemented slowly. As firms break past twenty employees, bottlenecks are created in decision making and things either don’t get done, or your competitors do them before you do. How many workflows or product lines do you have today because you’ve “always done it that way?” Firms with fewer than twenty employees have a different but also problematic decision-making process, which is that everything must be “run by” an owner before it gets approved, or before an employee feels as if they have permission to act. We’ll address each.

FOR EVERYBODY (THIS MEANS YOU)

The evolution of your business relies on better, faster decision making. According to the Harvard Business Review, organizations that follow decision checklists make decisions twice as fast in half as many meetings, find innovative solutions 75% more often and generate 20% better performance. Bain & Company found that decision making drives 95% of business performance and that when it comes to decision quality, speed, execution and efficiency, top companies outperformed average companies by 25%. Additionally, the Institute for Employment found that decision practices impact half of employee engagement. Your decision practices have a tremendous impact on how your business and your employees perform.

Most decision practices in business are the same; they have been used for decades, if not centuries. In fact, the traditional model is so ingrained in most people that there is a good chance that a lot of readers have already created a narrative in their mind that improving decision making can’t be possible, even despite the aforementioned data. Business training has taught people more about the importance of getting bogged down in excessive analysis than the practicalities of decision making. Then the instructions get passed down the organization chart and the vision (and intention) becomes muddied, like a corporate version of the telephone game. But if you allow yourself to consider the facts, you’ll see that addressing the bottlenecks in decision making can increase the pace and success of your growth. Traditionally, decisions come from the very top of the org chart and, quite frankly, out of nowhere from the perspective of the implementers. How a decision gets made needs to be more understandable to those responsible for doing the work, by allowing for more input and with guidelines to make it more consistent and repeatable.

The concept isn’t much different from what you should be doing for other tasks in your company, which is to create standard operating procedures (SOP’s), which are instruction manuals for employees to refer to in order to be able perform regularly occurring tasks when you’re not there. And decision making is indeed an everyday occurrence. The only thing better than an SOP is an automated process. My advice will help you get closer to automation. And even better is that it will help get your employees to act like owners by involving them. When we have employees that act like owners, we can step away and focus our attention on the core areas business owners and C-suite executives should be attending to.

That is not to say that all decisions are equal. Owners and chief executives will need to make a handful of major strategic decisions every year, big decisions that should be irreversible and warrant a very high level of due diligence. However, in a given day, there are dozens of trivial decisions that are made, many that owners or chief executives don’t even notice. We’re not going to discuss either of those. We are going to focus on the two or three important business decisions that are made each week, that: a) are run by the owner or chief executive even though input is required from other workers, and b) come from the owner because no other employee, for whatever reason, has initiated the task.

FOR GREATER THAN 20 EMPLOYEES

Even in decisive companies, there can be ambiguity as to who is accountable for which decisions. As a result, decision making can get clogged. To clear up that bottleneck, the most important step is assigning clear roles and responsibilities in the process, because if too many people are accountable, then nobody is. The process should consider who gives input, who must agree (mostly for regulatory reasons), who has the final say, and who is accountable for getting the job done.

Recommend: These are the people who are responsible for recognizing or being informed of a need or an idea, gathering input from peers, building “buy-in” along the way, and making a proposal. Theoretically, this can be anyone. It’s as much a role as it is a responsibility that is encouraged from a culture of sharing and communication, as well as acknowledging and rewarding those who assume this responsibility. You want to empower your people to solve problems affecting their work.

Input: These are the people who should be consulted to determine how practical the proposal is. It is worth noting that involvement is more important than agreement. You don’t need a consensus to move forward on a decision, but it is expected that you involve the people who will be working closest to whatever change is potentially coming. Often, the best ideas are not ones that are widely accepted. Just because it’s unpopular doesn’t make it wrong. But if you don’t involve people and get their input, you’ll never get their buy-in, and you risk mediocre results. These people are encouraged to disagree, if they do, but expected to commit to supporting the decision.

Agree: For compliance reasons, you do need someone checking to be sure you don’t run afoul of your regulators. Very few people should have veto power over a decision.

Decision Maker: Eventually, one person will decide. And for this conversation it shouldn’t be the owner or chief executive. This person is the single point of accountability, who must commit the organization to act on it, recognize that there will be risk, uncertainty, and disagreement, and bring it to closure. They also have the authority to resolve any impasse that may come up in the process. They must also communicate clearly the decision being made, and the reasons why.

Implementation: In some instances, the person who made the recommendation should take charge of implementing, which makes sense since they were likely the ones closest to the initial observation. The decision maker will assign that team and be responsible for feedback to measure results and collaborate, where and when needed.

Good decision making requires the right process, but you don’t want too many rules because you want flexibility and you want to avoid bureaucratic stalling. A good decision executed quickly beats a brilliant decision that doesn’t gain traction.

FOR FEWER THAN 20 EMPLOYEES

If you are the Hub of a Hub-and-Spoke company, decisions are going to kill you. You may feel like every decision has to be run by you, but that is not a good idea. Remember when you hired your first few employees and you felt as if each of them had to be near-perfect versions of yourself? But then you realized that you needed different skill sets to support a growing company? The evolution here isn’t too dissimilar. Originally, you needed more hours in the day and you couldn’t change that so you thought it was all about cloning yourself. Then you realized the power of scalability and the leverage of diversified skill sets. Well, once again, it’s not all about you. It’s about a better way.

And don’t fear making the decisions too quickly. We’re more likely to struggle with too much analysis versus too little. Growing companies’ most valuable assets are their people. If they are not involved in the decision-making process, not only do companies fail to harvest their experienced perspectives, but they risk losing those same employees to competing firms who will listen to them. The more you institutionalize, standardize, and track the decision-making process within your business, the quicker everyone can get aligned on the path forward and realign when things don’t go as planned. This is how you’ll beat your competition.

THE BOTTOM LINE

The vast majority of businesses see Wayfair bringing 100 jobs to the area as a positive for county (45.7%) or for them specifically (19.6%). Some are concerned about competing for workers (13%) in an already tight labor market. A healthy dose of skepticism on this opportunity exists, with 17.4% selecting the box saying, “Yeah, right. We’ll see if that happens.” A smaller group (4.4%), were not aware of Wayfair’s intention to open a call center in Pittsfield and hire about 300 people.

On the subject of the nation and the Berkshires tracking one another, small business optimism took a bit of a pause locally, with the overall BCI dropping 2.35 points to 57.97. Nationally, according to the National Federation of Small Businesses, after four straight months of overall increases, last month it dipped slightly. The NFIB’s President summed things up, “Last month, small business owners curbed spending, sales expectations and profits both fell, and the outlook for expansion dampened.” Locally, some of the struggles include increasing costs, reduced access to capital, worse year-over-year sales, and a decreased ability to raise prices.

YOU’RE NOT AS IMPORTANT AS YOU SHOULD BE

You’re too smart to be doing half the crap you’re doing now.

You should be more important to your business, but you do too much. You’re too busy doing the stuff other people should be doing and it’s to the detriment of your corporate growth. That makes you self-employed, and not a true business owner. The difference is that the business owner thinks about reinvestment, growth, infrastructure, and the redeployment of capital to build a business. If you’re self-employed, that means you’ve just made for yourself a glorified job. Sure, maybe you’ve been around for decades and maybe you’ve grown. But don’t kid yourself—if you can’t walk away from the business today with minimal impact to your company, then you’re not a business owner. But congratulations on making a nice living for yourself, keeping yourself busy by doing all the things your employees should be doing.

Annoyingly, the busier we are, the more we switch tasks. Feeling busy is not conducive to deep concentration. Multitasking on a high level is a fallacy. Our brains are built to focus on only one thing at a time. All evidence suggests that “mulitaskers” do not have some sort of gift to be able to juggle multiple projects. They simply shift focus from one project to another task. According to repeated testing, in cognitive tasks heavy multitaskers underperform. Our brains are not wired that way and it confuses the circuits in our brains and it makes us feel anxious that someone is waiting for us. I’m guilty of it. We call it procrastination. An everyday example of that for most people is responding to e-mails while working on a more important project.

Sure, you can drive and text at the same time and avoid killing people, but only because your brain switches to an autonomous function for actions as routine as driving. But if you are one of the top executives at your company, and if you’re doing things that are so simple that your brain does them automatically, you’re a bad manager. You should pay people to do things that are repeatable and teachable. You should, as I call it, operate at the top of your license. Whatever you do that is worth the most to the company, that thousand-dollar-per-hour activity, you should only be doing that, or thinking about how to do that better. It doesn’t mean you don’t/can’t do other things in your downtime. You lose time every day by being distracted. Estimates vary, but on the high end one study found that on average it takes us 23 minutes and 15 seconds to regain deep focus after an interruption, or switching tasks. Don ’t do someone else’s work, work you should be delegating, because you feel anxious about not doing something. Thinking is doing something. You are successful because of your brain – don’t be afraid to use it.

Let’s face it, we’re overly challenged when it comes to using our brains. Our offices are set up for convenience, not to maximize the use of our brains. If you’re like me, you’re not afraid to take off Fridays and work Sundays, when nobody is around to bother you. In three or four Sunday hours, you can get done what you would normally get done in a day-and-a-half during “regular business hours!” The problem during the work week is that too many owners and chief executives spend the majority of their time in meetings, on the phone, responding to e-mails, or talking to people about work, as opposed to actually doing the work—too much time being distracted. And by getting work done I don’t mean just any ol’ thing that keeps you busy. I’m talking about your big brain being used for high-value tasks. Think about perhaps one of the best manufacturing innovations ever invented—the production assembly line. By focusing on one thing that the worker specializes in before passing it onto the next worker, they can concentrate on what they are good at and not be bothered with the rest. I want you to think about it as a production line for your mind. I want you to spend most of your time on the things most valuable to your firm. And the things that aren’t as valuable to your firm, guess what? Someone else can probably do it better than you anyhow, or at least you can teach them to do it better than you because it’s where they’ll concentrate their time and attention.

Disclosures

This communication may include opinions and forward-looking statements that although we believe them to be reasonable, we can give no assurance that such beliefs and expectations will prove to be correct. All expressions of opinion are subject to change.

Historical performance is not indicative of any specific investment or future results. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss of income and/or principal to the investor.

This article is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Nothing in this communication is intended to be or should be construed as individualized investment advice. All content is of a general nature and solely for educational, informational and illustrative purposes.

Any references to outside content are listed for informational purposes only and have not been verified for accuracy by the Adviser.

Allen is the CEO and Chief Investment Officer at Berkshire Money Management and the author of Don’t Run Out of Money in Retirement: How to Increase Income, Reduce Taxes, and Keep More of What is Yours. Over the years, he has helped hundreds of families achieve their “why” in good times and bad.

As a Certified Exit Planning Advisor, Certified Value Builder, Certified Value Growth Advisor, and Certified Business Valuation Specialist, Allen guides business owners through the process of growing and selling or transferring their established companies. Allen writes about business strategy in the Berkshire Eagle and at 10001hours.com.

SELL, SELL, SELL!

SELL, SELL, SELL!