Berkshire Business Confidence Index, Issue 2

Second set of results from the Berkshire Business Confidence Index, sponsored by Berkshire Money Management are available in PDF format here:

The Berkshire Business Confidence Index (BCI), sponsored and analyzed by Berkshire Money Management, indicates that there is a cautious level of optimism among Berkshire County businesses, as well as non-profit organizations that must make business decisions. We mailed out 5,000 surveys countywide, and received responses from the full spectrum of Berkshire industries—non-profits, retail, manufacturing, finance, lodging, real estate, etc.—each bringing their own voice to this survey. What we have gleaned from this month’s results is:

- Area businesses are anticipating modest growth for the Berkshires, however, they are conservative in their forecast as to how that will translate to sales for their own companies.

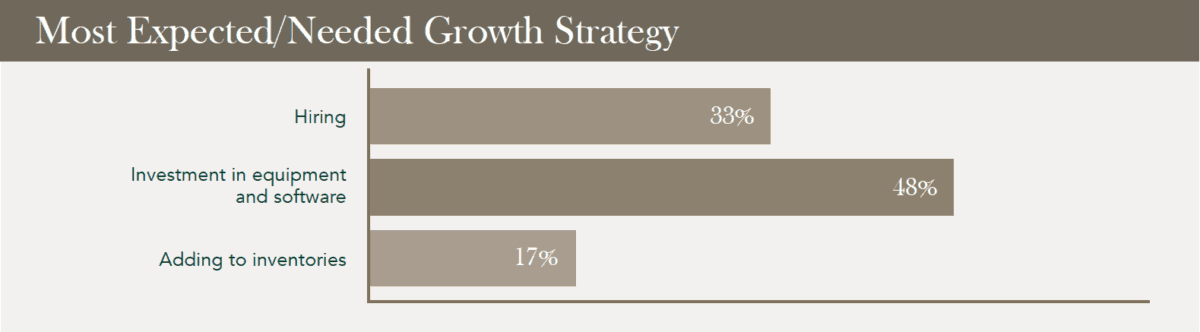

- Businesses are investing in new equipment and software, thus enhancing productivity and modernizing workflows. They have ample and easy access to financing to support their growth initiatives.

- Although, in general, it is difficult for Berkshire businesses to find the skilled labor they need, those that have been successful in recruiting do realize that as the community grows, their business grows. As such, businesses are generous and eager to share which recruiting tools have worked for them (and which have not).

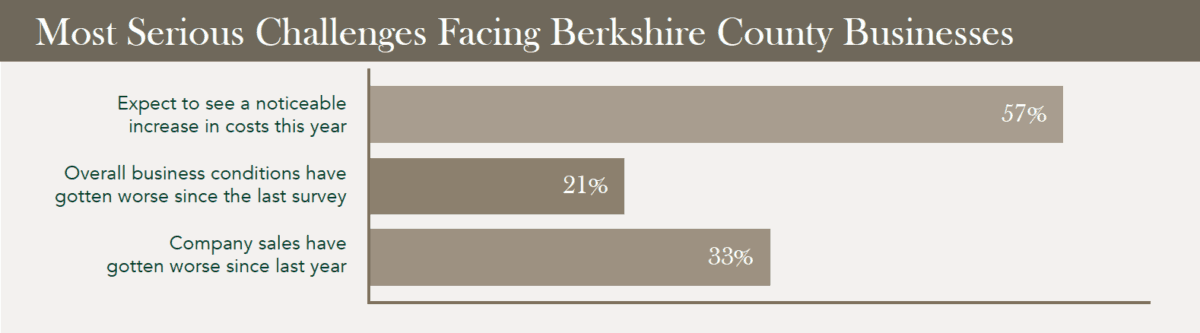

- Businesses want to grow, but their efforts have been stifled due to increasing costs. That shrinking profit margin discourages area businesses in making the effort to actively seek growth.

The ‘Numbers’

The Berkshire BCI for this survey period is 53.4, down slightly from the last survey’s 54.8, signaling continued optimism among Berkshire County businesses. A reading of greater than 50 signals increased economic activity. Less than 50 indicates a contraction in activity, and 50 corresponds to no change. Over time, as we continue reading and analyzing the surveys, the trend of that number will be important in determining the direction of confidence. Today, county businesses have mixed feelings, but are generally more optimistic. Let’s look more closely at the areas in which we collectively see opportunities or challenges by addressing some of the survey questions individually.

The Questions

Is your company expecting to see a noticeable increase or decrease in costs this year?

The answers to this question contained the most negative skew, for the second month in a row. Businesses are finding it a challenge to match sales growth to rising costs. The number did improve from 36.5 to 40.2. That is not a smooth jump, which is common in small surveys (5,000 people). However, the consistency of the reading for this (and for all the other categories) were similar enough to reinforce the findings of the previous survey. The numbers are seemingly reinforcing the survey and questioning method, as opposed to not capturing a radical change in mindsets or business environment over the last month.

This concern of rising costs and by extension, the corresponding crimp on profit margins, was noted in the editorial “The Amazonification of America” by Berkshire Money Management in the last survey results. We local providers of goods and services must work harder to deliver value to clients who shop for price. Adding services may, in fact, increase revenue. However, that revenue growth is seemingly, generally, not comfortably outpacing rising costs.

Increasing new services is a potential revenue and growth enhancer. However, not all costs correlate to possible growth. Area businesses cite pain points such as growing energy costs, high commercial property taxes, and the high cost of providing health insurance for employees. Health costs, in particular, have been a challenge. Nationally the remedy for this has been to hire more part time workers, thus eliminating the businesses’ obligation to purchase health care insurance for full time employees. The survey did not uncover this regionally, but it is a reasonable assumption that it has been considered by local employers.

When businesses are forced to meet the challenge of rising costs, they often make an operational decision which does not reinforce growth. The survey does not bear this out currently, but, at the risk of forecasting, area businesses cannot continue to struggle with this issue and simultaneously be expected to thrive. At the absolute risk of forecasting, we see the BCI being a tool, at some point, to gather decision makers to collaborate on these issues.

How easy is it for your company or organization to obtain financing on reasonable terms?

The answer to this question contained the most positive skew, increasing from 57.4 to 64.2. Last month the most positive skew was to the question “Is your company or organization investing in new equipment and software?” The number for investing in new equipment and software moved down just a little bit, still continuing to signal demand, now better matched with the funding available to do so.

Why the Berkshire BCI?

Why the Berkshire BCI?

We need to leverage the advantages other business managers see, and learn from their mistakes. I do not suggest that we “do this as a community.” Decision makers need to do it for themselves and for their businesses. Your job isn’t to figure out how to expand the skilled labor workforce in the area; your job is to figure out the best recruiting methods. The main mission of the Berkshire BCI is to provide you with the information you need, not just giving you confidence in making (or not making) a decision, but to actually provide to you possible choices. If the BCI becomes a tool for collaborative discussion and idea sharing, we have the opportunity to make better decisions.

The BCI can identify problems and then we, as a business community, can use each other as a resource. Some things are, in aggregate, too big of a scope for a quick fix (like expanding the talent pool of workers), but we may be able to help each other in terms of how we’ve recruited. We are finding that area businesses want to share their good business ideas, and help others steer clear of mistakes. I am envisioning this dialogue not as a tool for us to coax government officials to make changes gradually, but rather a tool for us to all share collective information so as to more confidently make changes and add value to our businesses.

The Bottom Line

Berkshires businesses see local overall economic growth as a positive to their financial outcomes, but the optimism they have for their own companies trail slightly their expectations for the region. This is because businesses are having great difficulty finding talent, and they are seeing profits shrink as costs are rising uncomfortably. If you fall into that category, you are certainly not alone. This sentiment is further reflected with a new question to the survey, our second such one. The question is “How have overall business conditions changed since the last time you responded to this survey?” The skew was negative.

Businesses want to buy new equipment and software, which are needed because of the difficulty in finding skilled employees. Given that businesses are finding financing easy, it seems as if there is a sales and marketing opportunity for area equipment and software providers as well as local banks to match efforts.

Is Quality of Life Really a Selling Point?

Is Quality of Life Really a Selling Point?

Well, first, I suppose, we have to acknowledge that each of us has a different opinion of what constitutes a good “quality of life”. Second, we have to clarify to whom we are selling this idea of quality of life. The questions in this month’s survey that were not directly inputted to the overall index centered around hiring. Because the BCI survey last month found that employers were frustrated with the lack of local skilled employees, one of those questions we asked was what your best “pitch” was to lure in out-of-town employees. And “quality of life” was offered repeatedly as the pitch.

Recently Berkshire Money Management placed in a local publication a relatively large, eye-catching ad for an executive level employee. We also used an online source. We received two resumes from people that we were not sure even read our ad, as the skill sets of the potential employees were remarkably different than what we were looking for. We did, however, via the online source, receive about a half dozen resumes from very qualified individuals. Four were salary shopping (and while we pay well, that type of attitude does not fit our culture; they were quickly disqualified from consideration). With two of the candidates, we discussed the wonders of working with BMM and the quality of life here in the Berkshires, and, yes, the salary. Role-for-role, most of us in the Berkshires are not going to be willing to match the salaries of New York City, or other metropolitan areas. But those two candidates were sold on the “quality of life”.

Unfortunately those deals could not be closed by BMM because, as one, survey respondent put it, the “cost of housing versus compensation” was too much to overcome, making “quality of life” a secondary consideration. When potential employees look at cost-of-living comparisons, they look at salary and housing and not much, if anything, else. The salary is the seller.

Our solution? I do not want to make this survey about BMM. But I do want it to be about solutions, when possible. So I’ll mention it briefly and invite you to contact me if wish to discuss how we present recruiting efforts and packages. I am no expert in the field, but sometimes it helps to talk these things out with other decision makers. We are likely going to hire young, coachable, smart talent and over the course of a few years fully hand over the duties. We have had success with this approach. Also, for other positions, we have hired an executive recruiter. I am more than willing to discuss any of this with you, as the survey respondents themselves have been very open in sharing.

Hiring: A need, and a challenge

The big reveal of the last survey was that businesses wanted to hire, but they could not find skilled labor in the area. This month we reached out via the survey and asked questions on the subject, and we wish to present to you the answers:

“What recruiting tools have been successful for your business in finding new employees?”

Survey respondents chose the following prompted choices: digital/print help wanted ads, train talent from within the firm, social media, and headhunter. There was not a lot to be learned from these answers. In retrospect, perhaps we should have made this question more open-ended. However, there were some write-in answers. A radio company, not surprisingly, said they used radio. Employers also shared that they use BerkshireWorks. A frequently written in response was “word of mouth”. If you have the time and interest, we would appreciate any comments you have regarding what has worked and what has not worked. You can e-mail them to me at AHarris@BerkshireMM.com if it is something we can share with our brothers and sisters in the Berkshires. All information will be considered confidential.

“What does your company offer to possible employees considering relocation to the Berkshires?”

This question got into the obvious and necessary (competitive wages; positive work environment), the attractive (matching 401k contributions; mentoring/training), and company perquisites (healing arts, massage, mani-pedis). To share some of Berkshire Money Management’s perquisites so that you can take them as your own, we offer tickets to local cultural events, continuing education, shopping trips, group “team building” travel, concierge services via The Errand Jeannie, massages, free company services (Social Security, Medicare, financial and estate planning), year-end gifts (sometimes directly from Santa Claus), ability to bring your pet to work, unlimited vacation time, and we help employees’ children with college payments.

“What is the most effective ‘pitch’ to new recruits?”

The results included: Outdoor recreation, culture/arts, lifestyle, affordable housing, less stressful environment, quality of life, steady employment, stability, upward mobility, opportunity to work for a mission-based organization, offer work-life balance, business longevity, and flex-time.

“If you have failed to close a deal on a new hire who was considering relocating, what was the candidate’s decided factor for declining the job?”

Unfortunately, the answers did not tend to be company specific. I say “unfortunately”, because as decision makers for our respective companies we have the power to more easily make changes, if need be. Instead, the deals did not close due to: Cost of housing versus compensation, higher taxes, limited regional growth, and a declining population. Those are elements that are out of our control.

Disclosure: Investment in securities, including mutual funds, involves the risk of loss.