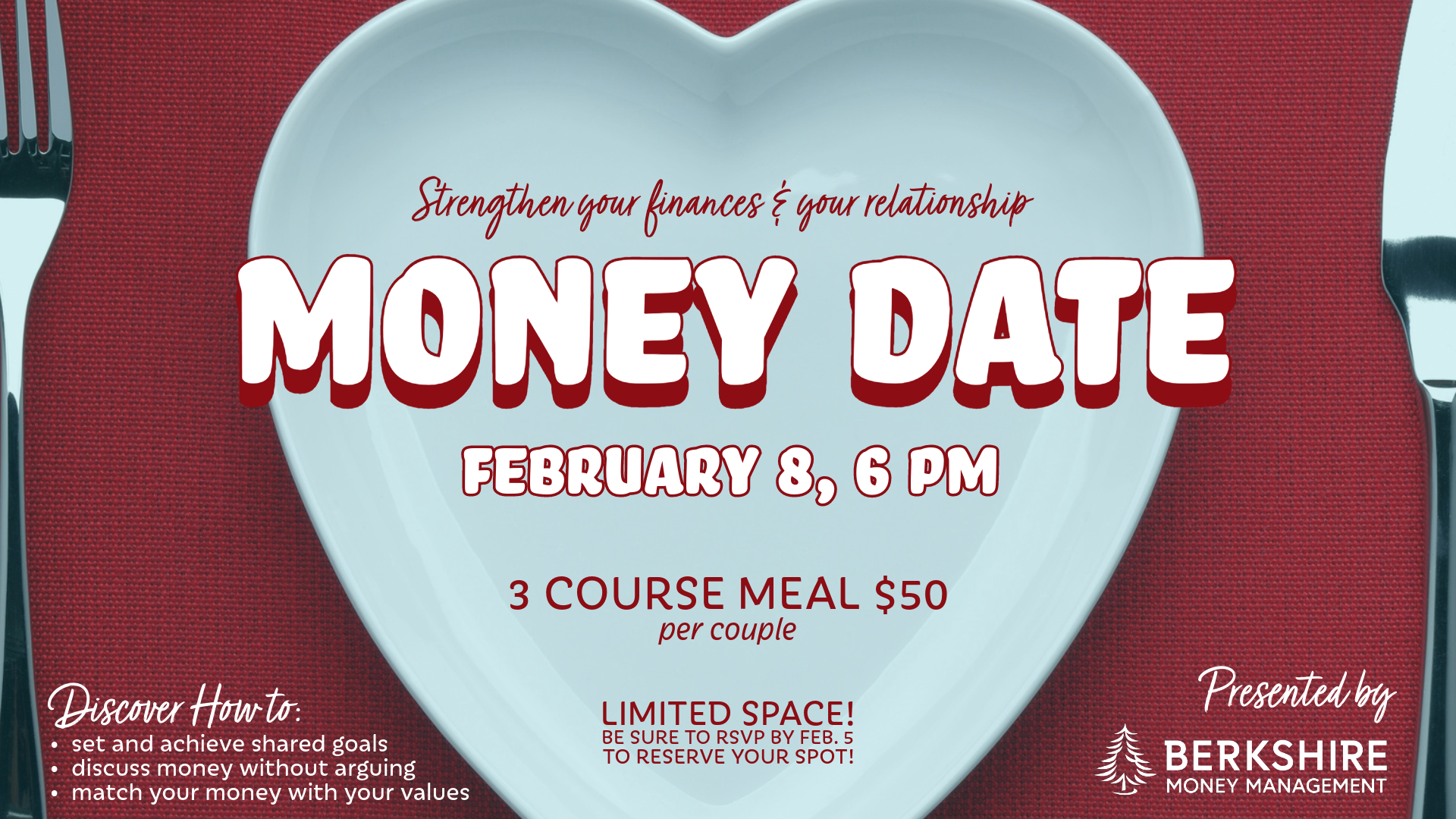

Money Date ♡ February 8, 2024

Join BMM’s team of licensed financial advisors and CERTIFIED FINANCIAL PLANNER professionals for an enticing and educational evening designed to strengthen your finances and your relationship!

During this special dinner date, you and your spouse or partner will discover ways to communicate more effectively about your finances, values, and goals, gain new perspective on each other’s unique relationships with money, begin making (or update) plans for retirement together, and more!

Table of Contents

Event Details

Date and Time:

Thursday, February 8, 2024

6 to 8 pm

Location:

Mazzeo’s Ristorante

1015 South Street, Pittsfield, MA 01201

Cost:

$50/couple, cash bar available

Included in your reservation:

Passed hors d’oeuvres, entrée of your choice, and dessert, plus presentation, discussions, and activities.

Best for:

Married and committed couples considering retirement in the next 10 years who would like help communicating about their finances and planning for the future.

Reservations:

Reservations are required. Tickets are available through Monday, February 5 or until supplies run out. Make your reservation online via Eventbrite or by calling (413) 997-2006.

Why take your partner on a Money Date?

When it comes to finances, many couples struggle to communicate effectively. The 2023 Consumer Saving and Spending Behaviors report by Bank of America reveals that just 42% of individuals feel comfortable discussing their finances with their romantic partners. According to the National Library of Medicine, 37% of divorced couples cite financial problems as a reason for divorce.

The licensed financial advisors and CERTIFIED FINANCIAL PLANNER™ professionals at Berkshire Money Management see effective communication as key in overcoming financial challenges in a relationship. They’ll be sharing their favorite tools and tips for navigating tough financial conversations and planning for the future during this special event.

What you’ll learn

The February 8 program will include presentations, discussions, and activities designed to help couples:

- understand each other’s relationship with money

- communicate effectively about their values, goals, and finances

- plan for shared and individual retirement goals

- balance short- and long-term financial goals

- have big “money talks” without arguments!

Kimberly is the Marketing and Communications Manager at Berkshire Money Management. She is dedicated to eliminating jargon and deciphering complex financial concepts so you don’t have to.