Berkshire Business Confidence Index, Issue 5

Spring 2018 Results from the Berkshire Business Confidence Index, sponsored by Berkshire Money Management

The Berkshire Business Confidence Index (BCI), sponsored and analyzed by Berkshire Money Management, indicates that there is a cautious level of optimism among Berkshire County businesses, as well as non-profit organizations that must make business decisions. We mailed out 4,000 surveys countywide, and received responses from the full spectrum of Berkshire industries—non-profits, retail, manufacturing, finance, lodging, real estate. Each brings their own voice to this survey. What we have gleaned from this month’s results:

- From the last survey (January 2018) to this survey, overall confidence was materially unchanged, dipping from 56.4 to 56.1. The most notable improvements came from respondents’ abilities to access financing and the intent of businesses to commit to capital expenditures (i.e. physical assets such as property, equipment, vehicles).

- Owners want to invest in their business and grow, but their efforts continue to be stifled by increasing costs. Shrinking profit margins discourage area businesses from making greater efforts to grow substantially. Increasing costs continue to remain the most negative skew of all the BCI components.

- Nearly every respondent indicated that they are comfortable with their revenue model, suggesting that they are confident that their “good customer service” will continue to win “loyal” and “repeated” customers, thus protecting them from losing market share to local competitors or national industry disruptors.

- The January 2018 survey assessed that a robust quarter of sales had just occurred and that this contributed significantly to a burst of optimism that was likely to be shed as sales normalized. This held true as the survey gauged last quarter to be significantly weaker than the previous quarter.

The ‘Numbers’

The Berkshire BCI for this survey period is 56.8, up slightly from the last survey’s 56.4, signaling continued optimism among Berkshire County business and organization leaders. A reading of greater than 50 signals increased economic activity. Less than 50 indicates a contraction in activity, and 50 corresponds to no change. Over time, as we continue reading and analyzing the surveys, the trend of that number will be important in determining the direction of confidence. Today, county businesses have mixed feelings, but are generally more optimistic. Let’s look more closely at the areas in which we collectively see opportunities or challenges by addressing some of the survey questions individually.

The Questions

How have overall business conditions changed since the last time you responded to this survey?

In the last survey, businesses reported robust growth in year-over-year sales. That component of the index had a massive jump, showing consistency with national data and evidence that Berkshire businesses were keeping up in terms of market share. We argued that there would be payback from that spiked optimism, and there was. The responses to this question had the second most negative skew, dropping seven points to 50.0. Business owners are feeling a bit of a sales hangover, coming off of a high. Given that hangover, the more important metric would be an apples-to-apples comparison of year-over-year sales. How strong are your company’s or organization’s sales

compared to last year? In January, we noted “year-over-year sales holds the distinction of experiencing

the biggest positive leap since the last survey.” This time around, year-over-year sales has the dubious distinction of the biggest drop of all the components, down eight points to 53.1.

Is your company or organization hiring?

The real news here is that there is no new news. This is the simplest of all questions (you know whether you are hiring or not), but also the most significant. Berkshire Money Management sponsors and interprets the data for this survey. One of our favorite economic indicators is the monthly payroll number; when used properly it is a leading indicator. Any single measure for any one survey is rather meaningless. The same can be said for national surveys. What is important is the trend, and the trend is that the intent of Berkshire businesses to hire remains high and steady, coming in at 62.1.

Has the cost and/or burden of government-imposed regulations changed over the last year?

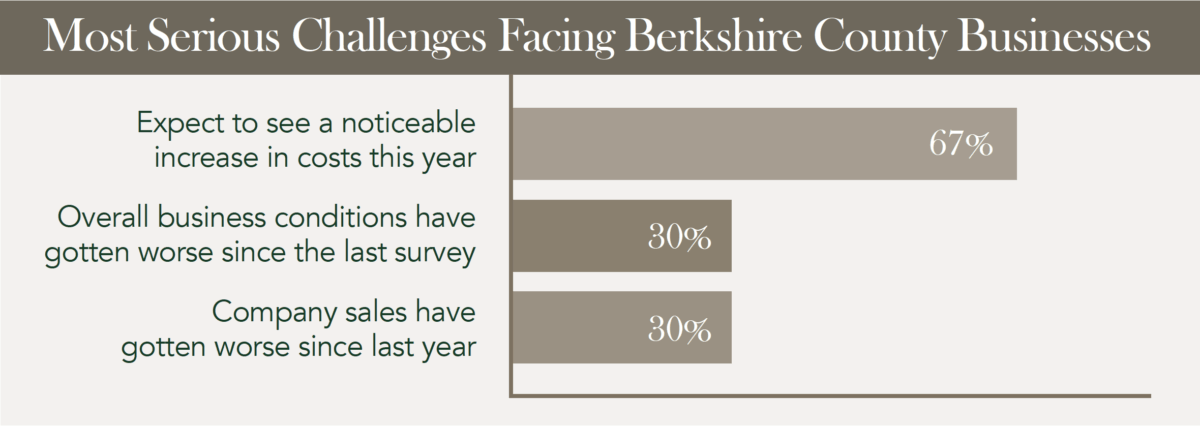

This presidential administration has been remarkably vocal about reducing and streamlining regulation. However, only a single respondent said that regulatory costs were lower, while 45.5% of respondents said that costs and/or burdens have increased over the last year. This is perhaps why the number of owners who expect to see a noticeable increase in costs this year bumped up three percentage points to 67%.

Why the Berkshire BCI?

We need to leverage the advantages other business managers see, and also to learn from their mistakes. We do not suggest that we “do this as a community.” Decision makers need to do it for themselves and for their businesses. Your job isn’t to negotiate utility costs for your municipality, or to build a university to create a skilled labor workforce. You must contend with market, or systemic risk.

Your job is to handle the challenges of unsystematic risk specific to your business. Whether that is to decide what are the best recruiting methods to build and sustain a reliable workforce, or to deliver a new service/product line to keep up with a changing marketplace. The main mission of the Berkshire BCI is to give you the information you need to make business decisions confidently and to provide potential choices, thus creating the opportunity to make better, more informed decisions.

The BCI can identify problems and then we, as a business community, can use each other as a resource. We are finding that area businesses want to share their good business ideas, and help others steer clear of mistakes. We see this dialogue as a tool for us to all share collective information so as to more confidently make changes and add value to our businesses.

The Bottom Line

In the last BCI, I wrote:

“The small businesses of the Berkshires are not just confident, but exuberant about economic growth…It’s likely the professional investor in me, appearing cynical when trying to be protective, but I do grow concerned when I see crowd consideration hit extremes…So I probably really need to stop worrying and enjoy the growth. But I won’t. You enjoy the growth, and I’ll keep worrying for the both of us. And I’ll let you know how that goes.”

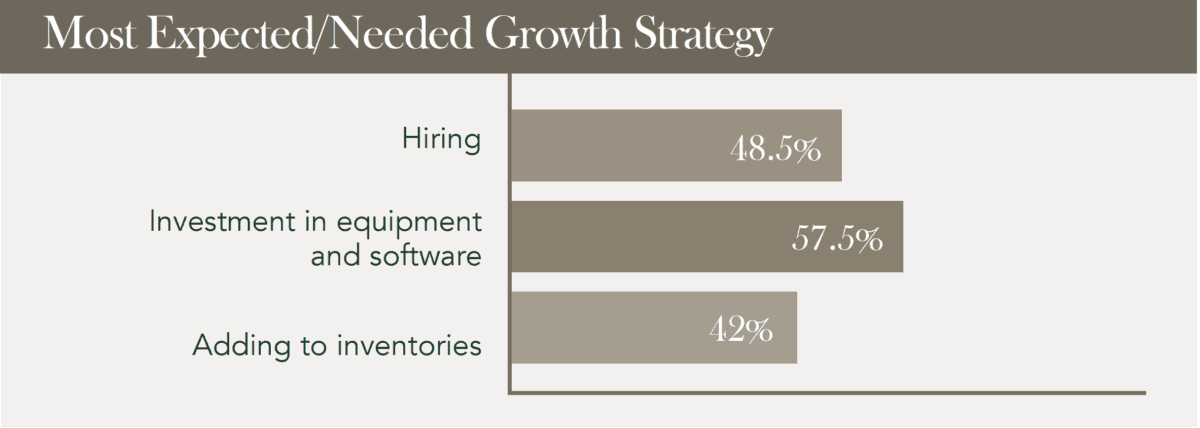

Well, I was right to worry. The overall BCI Index was flat, materially unchanged. But that number was buoyed by the big jump in the access to capital. That has been consistently high, but it jumped a notable ten points. Apparently, if businesses want to expand, financing is not going to be a problem. And that is important because the other consistent contributor has been the continued investment in capital equipment and software. Not only was that the second-highest contributor – but with a jump of four points, it was the second-largest increase.

So that was the good news. Back to the worrying. The overall number barely moved. However, there was a significant negative shift on the sales side. I had noted in the last survey that our numbers were “consistent with sales picking up…dramatically.” And that has been supported by anecdotal evidence (me talking to business owners when we run into each other) as well as by national and regional sales information that we purchase from data aggregators. Well, that sentiment shifted. The numbers took deeply negative turns on comparing sales to last year (down eight points) as well as comparing business conditions since the last survey in January (down seven points). The percentage of respondents who said overall business conditions have gotten worse since the last survey nearly tripled, from 12% to 30%.

That is very bad news, but based on our interpretation of national and larger regional surveys, we suspect this to be a temporary concern. March U.S. retail sales came in better than expected, rebounding 0.6%, its first increase in four months (vehicle sales were a big part of it). That bounce back leads us to believe sales will pick back up, and that the weakness at the start of the year was temporary, and likely due to severe weather as well as delayed tax refunds as a result of a change in IRS procedures (which hurt disposable income levels this February compared to 2017). These past drags on spending have faded.

In sum, Berkshire business owners were a bit too optimistic last quarter and are a bit too pessimistic this quarter. They will use that access to financing to invest more in capital and technology. The number of those intending to do so leapt from 64% to 75%, although don’t get too excited, this could be as low level as, say, upgrading from a ledger to QuickBooks. And if they can do so, they will hire more. The number of respondents looking to hire jumped from 38% to 48.5%. Also, many respondents are looking to add inventories (an increase of fifteen percentage points). It seems to me that business owners are feeling some short-term pain, but in their gut they feel that there are opportunities to pursue (and like I said, we business owners are good at following our gut).

Work/Life Balance is Stupid

I like to work, and I bet you do, too. So when I hear people talk about work/life balance, I usually think that they aren’t speaking my language. Sure, I like to have days off and take vacations. But I never got that “balance” thing, because I like my work. I want to be connected to work. I want to know about corporate earnings, and international trade tariff tiffs, and the relative performance of tech stocks versus the consumer staples sector. That’s fun for me. So when people talk about the need for a work/life balance, I generally tune them right out. They don’t get me – they don’t get you. I know you know what I’m talking about.

So, when I, Allen Harris, talk about work/life balance, it’s not about getting out of the office, it’s about being able to get out of the office.

There are many Berkshire business owners who run lifestyle practices. These business owners usually make a lot of money, generating an enviable six-figure income. That’s because, in part, these businesses are set up and run by a founder with the nonstated goal of sustaining a certain level of income, thus sustaining a particular lifestyle.

These owners are overly tied to the company, often being far too intimately involved with nearly all aspects of client interaction. They fail to smartly and successfully delegate. The result is that they are constantly scrambling on this sort of hamster wheel of success. These owners are tied to the belief that they must do it all, and that no one else can even come close to doing it well enough. That belief crushes scalability. A lack of scalability means that a new customer brings in incremental profit while putting exponential stress on capacity. These are the owners who can never sell their business because it is worth practically nothing: They don’t own a business so much as they are stuck in a glorified job.

On the opposite side of that spectrum are the business owners who spend too much time away from the office to vacation or pursue other interests, finding that they are not keeping up with the growth of the industry. Losing market share to their competitors jeopardizes the very existence of their firm.

For each business, there is a unique set of steps that should be taken to maximize business income and to move from being a lifestyle practice to being a business that is so profitable and so well-managed that you could sell it whenever you wanted to. And at a premium. I get it, not all of us are ready to sell. I’m only 45 years old. I’ve got at least two decades before the next generation purchases all of my shares. But in the meantime, running my business like it is going to be sold 1) increases my income, 2) shores up any weaknesses or inefficiencies, 3) prepares the firm should I unexpectedly die or become unable to run it.

I write about this in my book Build It, Sell It, Profit. If you would like a copy there is a link in the Business Owners section of BerkshireMM.com.

If you have already read it, allow me to give some advice that I did not put into the book: Learn how to say “no.” Does that sound too negative to you? Ok. Fine. Let’s rephrase it. Write down the top three to five things you do for your business, then write down the other couple dozen things you do. Now, do those top three to five things. That’s your job. And don’t you ever touch anything else on the list. It’s an oversimplification, but this is a four-page newsletter and not a 200-page book, so please indulge me in some oversimplification.

If you want to get a sense of your best strengths and biggest weaknesses, I invite you to go to the Business Owner’s section of BerkshireMM.com and take the 13-minute survey to get your Value Builder score. The Value Builder System is a program that assesses the current value of a business, creates a plan for improvement, and helps owners take action. Being a fan of statistics (and of building my business), it is interesting to note that companies with a score of 80 or higher typically receive purchasing offers that are 71% higher than average-scoring businesses.

Your Revenue Model Sucks

I was shaken by the number of respondents who didn’t give much consideration to their revenue models. To the question, “What type of revenue stream do you have?” an alarming number of respondents penciled in “not applicable.” We did not offer up “not applicable” as an answer option, because, well, with all due respect, it most certainly is applicable. I suspect that a good amount of the “N/A” group consider that what they sell will always be sold the way it is now. I’d encourage you to think differently.

Maybe you’re a florist, and you rely on proms, weddings and the occasional gala to sell our flowers. You have a good reputation and you get a good amount of word-of-mouth business, and that’s how you make your living. I encourage you to think differently. Sell a monthly subscription to businesses and upscale residences, where you’ll switch out last month’s bouquet with a new one.

Maybe you’re a clothing retailer, and you rely on someone walking into your shop to buy a suit for a wedding, or a new shirt for a gift. I encourage you to think differently. Provide a service where for a recurring fee you, the stylist, send your customers a trunk of new clothes to try based on what you think they might like. That recurring stylist fee can be deducted from any purchase your customer makes.

Maybe you sell fitness equipment. And maybe nobody uses that equipment once you sell it so you have very little recurring maintenance revenue and probably only sell equipment when it comes time for people to make a New Year’s resolution. I encourage you to think differently. Sell a subscription with that product with a built-in streaming class so that people keep using that product and then they tell everyone else to use it, too, to join their tribe.

Maybe you sell HVAC equipment and you make good margins when a new home is built, but your profits go down when the cycle slows. I encourage you to think differently. Sell a monthly service where you visit the equipment, clean and maintain it.

Maybe you’re a grocery store, selling only the goods that people need when they make it onto the shopping list. I encourage you to think differently. Create a service that provides a meal recipe along with the required ingredients. Or set up a recurring delivery of your customers’ known staples.

I encourage you to think differently, to abandon what you do when you do it only because it is what you’ve always known. Abandon the pay-per-use type of business model. It’s what your clients prefer, and it makes your revenue stream more predictable (both being factors that increase owners’ income and business value).

The best businesses on the planet have some component of automatic-renewal subscriptions. And it’s not an Internet versus brick-and-mortar thing. These monster companies are using technology to give your customers (yes, yours) an easy solution, not only that they prefer, but which is scalable to the business.

A massive chunk of Amazon’s revenue is from its automatic renewal program, Amazon Prime and AWS. There is also Netflix, Blue Apron, Dollar Shave Club, Spotify, Stich Fix, Pelton—all growing by leaps and bounds based on subscription models. According to Forbes, “in the month of April 2017, subscription company websites had about 37 million visitors. Since 2014, that number has grown by over 800%.” Your customers see value in this subscription revenue model.

If you’d like to consider strengthening this or other parts of your business more deeply, then I invite you to take the 13-minute questionnaire on the Business Owner’s page of BerkshireMM.com to get your Value Builder Score. Or maybe you already see the value and want to forge ahead, then you can just go to Cratejoy.com or Shopify.com.

Cratejoy’s software is an all-in-one solution for subscription boxes of all sizes. Shopify is an e-commerce platform that allows you to set up an online store to sell your goods. Those aren’t the only two that do what they do (you can search the web for dozens of competitors; I’m just trying to nudge you in the right direction). And I don’t use them. Berkshire Money Management uses platforms that just wouldn’t work for most other companies, for various reasons (I wanted to lead you toward a solution that is more fitting to everyone).

So, to sum, 1) every business can convert some revenue to recurring, and 2) the benefits of recurring revenue include, but are not limited to, predictable income, scalability, increasing profit margins, and higher levels of customer retention. Not only can you unlock the door to more owners’ income, but you can make your business more valuable. All while giving your customers what they want.

Excellent Customer Service is a Minimum

I have a lot of business stuff I want to share beyond what I glean from these surveys. Some of it is good advice. Some of it is strong opinion. This here, it falls into the opinion category.

A vast majority of the business owners I speak to feel as if they don’t have do things differently than they have done, or that they don’t have to update their operations and business model as quickly as their competitors. Why? Because their customer service is just so darn good.

You cannot differentiate your business from others based on good customer service. Why? Because good service doesn’t impress people when excellent customer service is the new minimum. Excellent service is so prevalent now you hardly even notice it: scheduled and automatic shipments of every product to your doorstep, you can summon a car with a phone app and they are there in minutes, “geniuses” that combine tech savvy and a winning smile to get you set up with your latest purchase, businesses that can recommend to me other products I might like based on my previous purchase.

I hate to admit it, but I’m not at all special because we offer excellent customer service. That’s the norm. If we aren’t doing more, we aren’t doing enough. But that’s just my opinion.