Berkshire Business Confidence Index, Issue 4

Winter Results from the Berkshire Business Confidence Index, sponsored by Berkshire Money Management

The Berkshire Business Confidence Index (BCI), sponsored and analyzed by Berkshire Money Management, indicates that there is a cautious level of optimism among Berkshire County businesses, as well as non-profit organizations that must make business decisions. We mailed out 5,000 surveys countywide, and received responses from the full spectrum of Berkshire industries—non-profits, retail, manufacturing, finance, lodging, real estate. Each brings their own voice to this survey. What we have gleaned from this month’s results:

- From last survey (September 2017) to this survey, overall confidence expanded slightly. The most notable component gain came from the improvement of year-over-year sales and the addition of inventories to match those sales (portending, in part, a robust holiday spending season).

- Almost one fifth of respondents intend to sell or merge to a larger acquirer within the next two years, but only two percent of respondents are interested in buying or acquiring, meaning that many businesses existing today will disappear upon an owner’s retirement. Over one third of respondents intend to sell within five years.

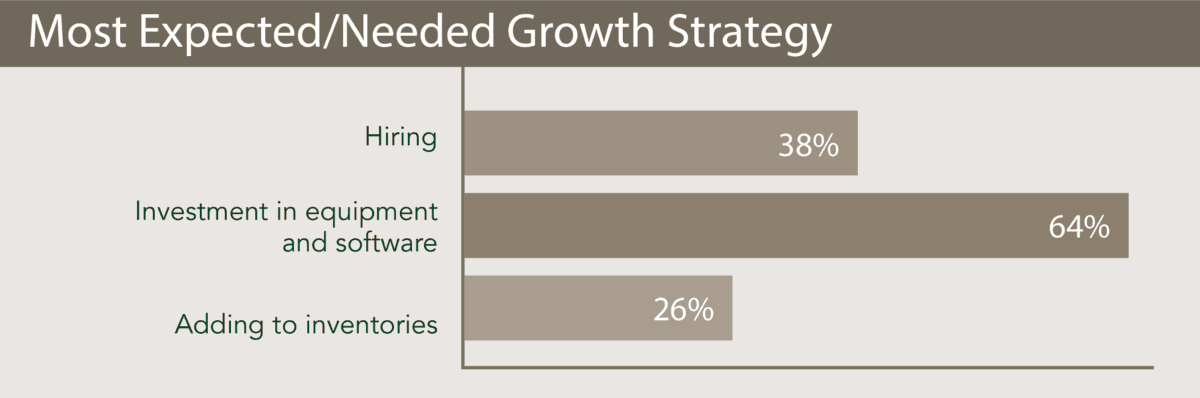

- There is a continued demand for new equipment and software. Business owners are preparing for a business model that will “look substantially different” in the years ahead (per the previous survey). A majority of respondents say that they have ample and easy access to financing to support their growth initiatives. These two factors, intent and ability to follow through on that intent, continue to be the most positive contributors to the index total.

- Area businesses are using a variety of educational/informational sources to address the radical changes—technological, demographic, and political—they expect in their respective industries.

- Businesses absolutely want to grow, but their efforts have been stifled due to increasing costs, notably in utilities and payroll expenses. This shrinking profit margin discourages area businesses from making greater efforts to grow substantially.

The ‘Numbers’

The Berkshire BCI for this survey period is 56.4, up slightly from the last survey’s 55.6, signaling continued optimism among Berkshire County business and organization leaders. A reading of greater than 50 signals increased economic activity. Less than 50 indicates a contraction in activity, and 50 corresponds to no change. Over time, as we continue reading and analyzing the surveys, the trend of that number will be important in determining the direction of confidence. Today, county businesses have mixed feelings, but are generally more optimistic. Let’s look more closely at the areas in which we collectively see opportunities or challenges by addressing some of the survey questions individually.

The Questions

Is your company expecting to see a noticeable increase or decrease in costs this year?

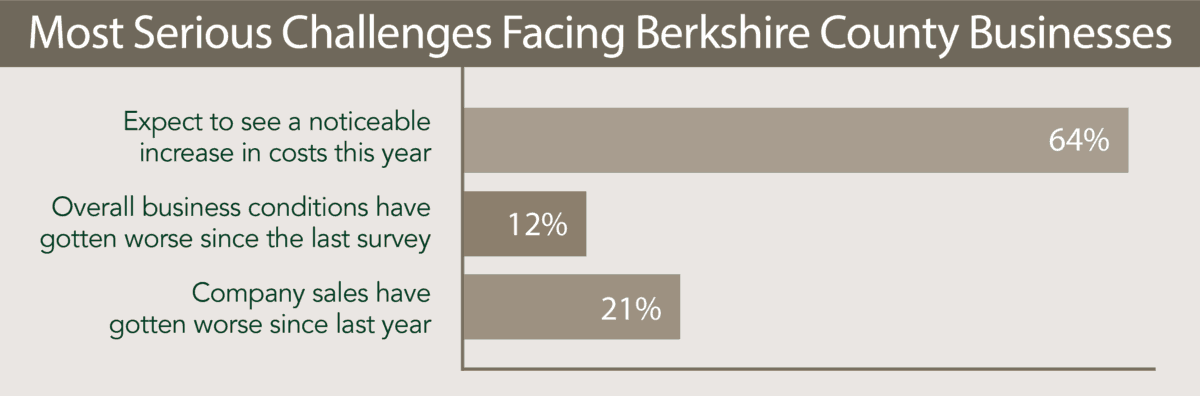

Yet again, the responses to this question continue to contain the most negative skew. The numbers from the last survey to this one indicate a continued challenge by businesses to reduce costs, with the number showing only a slight improvement from 34.4 to 35.7.

How strong are your company’s or organization’s sales compared to last year?

Apparently it is going to be a very good holiday spending season in the Berkshires. Year-over-year sales hold the distinction of experiencing the biggest positive leap since the last survey. This is consistent with national surveys. Mastercard SpendingPulse reports that holiday sales increased 4.9 percent this year, setting a new record for dollars spent. This is the largest year-over-year increase since 2011 and a further indication of consumer confidence. Berkshire retailers are not being left behind. Our survey considers trend more than magnitude, but the 10.9 point jump up to 61.9 in the BCI argues that areas businesses have been able to compete for market share against online retailers.

Is your company or organization adding to inventories?

In response to the large jump in year-over-year sales, businesses are ramping up their inventory levels. This made up the second largest jump, up 7.2 points to 58.1 points. It is natural and self-explanatory that inventories would increase along with sales. What is important is that the growth rate of inventories is tempered relative to sales, allowing business to go into 2018 with higher cash levels and less of a need to cut prices to clear shelves for new or updated products.

Why the Berkshire BCI?

We need to leverage the advantages other business managers see, and also to learn from their mistakes. We do not suggest that we “do this as a community.” Decision-makers need to do it for themselves and for their businesses. Your job isn’t to negotiate utility costs for your municipality, or to build a university to create a skilled labor workforce. You must contend with market, or systemic risk.

Your job is to handle the challenges of unsystematic risk, specific to your business. Whether that is to decide what are the best recruiting methods to build and sustain a reliable workforce, or delivering a new service/product line to keep up with a changing marketplace. The main mission of the Berkshire BCI is to provide you with the information you need – not only to give you confidence in making decisions, but also to provide potential choices, creating the opportunity to make better, more informed decisions.

The BCI can identify problems and then we, as a business community, can use each other as a resource. We are finding that area businesses want to share their good business ideas, and help others steer clear of mistakes. We are envisioning this dialogue as a tool for all of us to share collective information so as to more confidently make change and add value to our businesses.

The Bottom Line

The small businesses of the Berkshires are not just confident, but exuberant about economic growth. I purposely selected that word because I often recall the Fed chairman’s famous 1996 phrase “irrational exuberance” regarding froth in US stock prices. There may be froth in the opinions of area decision makers. And I may be guilty of that myself, recently hiring as well as acquiring a new office building. But whether the optimism is only frothy or truly “irrational” probably matters little for now. In retrospect, US stock prices were clearly irrational in the late 1990’s, but they improved for three years before hindsight made it clear.

It’s likely the professional investor in me, appearing cynical when trying to be protective, but I do grow concerned when I see crowd consideration hit extremes. Granted, the BCI is new. But it has been consistent with the 44-year-old National Federation of Independent Business (NFIB) Optimism Index and other similar national metrics. And the NFIB Index, for example, has only been as high as it is now back in 1983. The good news is that US GDP skyrocketed for the next eight years before a mild recession in 1991. The evidence (and history) suggests that the soft date optimism will translate into continued improvement of hard data (hiring, wage increase, manufacturing, etc).

So I probably really need to stop worrying and enjoy the growth. But I won’t. You enjoy the growth, and I’ll keep worrying for the both of us. And I’ll let you know how that goes.

The biggest component jumps in the BCI came from year-over-year sale and an increase in inventories. Most other questions were flat from the last survey, showing consistency in the methodology, with four components detracting relative to the last survey (can’t raise prices, stagnant hiring, not expanding Berkshire facilities, and slightly degraded financing conditions), but still adding to the overall growth. Only 12% of respondents feel as if overall business conditions have gotten worse since the last survey, compared to 21% before. That is consistent with sales picking up so dramatically.

The most spectacular findings in this survey came from the additional questions that are not computed into the index itself. A lot of business are planning to close within the next few years: 19% of respondents reported intentions to sell or merge within the next two years, and 36% reported intentions to sell within the next five years (which corresponds to the average age of many business owners). However, there is not much clarity on how to sell or who to sell to, and only two percent of respondents are interested in buying or acquiring, meaning that many businesses will disappear upon an owner’s retirement.

Succession planning is important to the local economy. There is a lot of discussion about bringing in new businesses, and while that is important, the BCI is more about helping current businesses. And, by extension, it’s about helping current businesses stay in businesses when owners decide to retire.

Yesterday’s Opportunity Became Today’s Challenge

Per the Berkshire BCI, the two biggest concerns have been 1) the lack of available skilled labor, and 2) the disruptions occurring to each of our business by what I have referred to as “the Amazonification of America” (aka, the Amazon Effect). I compare these two concerns side-by-side, and it reminds me that problems do become opportunities.

The Amazonification of America is changing end-user preferences and introducing new industry-disrupting technologies that are changing the way we have to do business to remain relevant. It’s a problem. But it is also an opportunity. The opportunities will be unique to each industry. For example, in my industry, investment and wealth management, emerging investors are often ignored, but BMM is using a disruptive technology called informally a “robo-advisor” to help emerging investors (those, for example, with as little as $5,000 socked away in a savings account). “Robo-advisor” is a term used pejoratively by “old-school” advisors that are ignoring the disruption.

Just shy of a decade ago, the biggest problem was a lack of confidence in the economy. It wasn’t the concern of a downturn; we had just gone through that. It was the concern that the economy would not come back. What did happen instead was that the U.S. Gross Domestic Product (GDP) grew from about 15 to 19 trillion dollars. That pessimism was an opportunity.

Today, the biggest concern of current employers is that there are not enough skilled employees to hire. Berkshire County entered 2010 with a 10.2% unemployment rate. That has improved substantially since then, falling to 4%. That’s why local employers argue that their biggest problem is finding qualified workers – they’ve been getting hired for eight years.

On December 6, 2009, I wrote the below Letter to the Editor to the former owners of Berkshire Eagle. They must have thought I was crazy, hiring people when the economy was near its worst, because they refused to publish the letter. (Thank goodness our local newspaper now has a more business-centric ownership). Below is that unpublished Letter to the Editor.

Berkshire Money Management

Again, a thank you to the new owners of the Berkshire Eagle for being more forward-thinking. And, I suppose, a thank you to the former owners, too, because they help me drive home my point. What is difficult (or seemingly crazy, at times) in business is often the path you should follow. If you wait until all of your competitors take action, you will be forced to play catch up as others outgrow you. Don’t let today’s opportunity (even if it is disguised as a challenge) of a rapidly changing business landscape be your problem tomorrow. E-mail me at AHarris@BerkshireMM.com; I’d love to hear about your current challenges, and we can put those out to fellow readers to determine how to turn them to opportunities. But in case you’d rather read about a few ideas for now, I can offer some general advice.

Stay small – Be able to focus on your clients with a white-glove level of service. For example, BMM is a hospitality firm that just so happens to manage money well.

Be convenient – The old-school mentality of doing things the way you’ve always done them may feel comfortable, but it’s the best way to turn off new customers who find new communication methods or client onboarding sequences to be more convenient than accepting the quaint feel of an antiquated process. BMM routinely compares its documented workflows to those of other businesses.

Offer value (not price) – BMM isn’t the most expensive service in the nation, but we’re also not the cheapest in the Berkshires. And we don’t strive to be. We aim to deliver so much more than any of our competitors that cost is never even a consideration to our clients.

Our last survey asked, “Have you received a valuation of your business in the last twelve months.” Only 2.5% said yes, and mostly through an online calculator. The vast majority of “no” answers said there was “no need” to acquire one. I supposed a need is subjective and it would be difficult for me to argue that in relative terms. However, valuation tools aren’t just for knowing how much you could sell for. The valuation process can allow you to see yourself from an angle that doesn’t just give an informational snapshot, but a roadmap to building a better business.

Yes, getting a valuation is important to someone looking to sell. In that instance, the sooner you know your worth, the better. If you wait until you are 65, a traditional retirement age, you may not have time to make the necessary corrections and might have to postpone retirement indefinitely. By getting a valuation well in advance, you will know where you are starting so you can create a plan to get to the finish line. You can begin your financial planning for retirement with some sense of certainty. And when you do enter negotiations for a sale, you will not be making unreasonable demands for the price and terms that you think you deserve, which is what kills most deals. Both you and your buyer will know what is a fair and acceptable market value, which is what leads to a quick and healthy deal.

By helping you to understand a buyer’s perspective, the valuation is an essential tool for your strategic planning. You need more than some rough guideline for your industry that indicates, for example, that your business should be worth two times revenue. That ballpark formula is nice to know, and it could even be a broad basis for some early planning, but do not depend upon it. Your business has a unique set of strengths and weaknesses, opportunities and threats – or SWOTs, for shorthand. A rule of thumb does not recognize your specific circumstances. To develop a tailor-made strategy, you need to obtain a formal valuation. You are special, after all – and the valuation will show you just how much so.

A valuation report for your business will be based on precise data that you submit for professional review. The expert will use a reliable methodology that inspects your processes, documents your workflows and pipeline, examines your management, and more. You can then engage in the strategic planning that can help you attain top dollar when you sell. You will be able to put together a seller’s package of demonstrable data that supports your asking price.

The valuation report thereby serves as validation that the price you are seeking is reasonable. It also dissuades you from pursuing a price that is unreasonable. When both buyer and seller have realistic expectations, deals happen. A prospective buyer, by nature, will tend to undervalue the business, just as the seller will tend to overvalue it. With the valuation report in hand during negotiations, you can say: “With all due respect, here is a third-party analysis suggesting our price is fair.” Often, what buyers want is confidence that they are not being ripped off.

Confidence motivates action. You have to know what you need to do, from a buyer’s perspective, before you can do it. The valuation report will let you know if it is time to take out the garbage. There are plenty of free online valuation calculators available, but those generally are not the best sources. Receiving a proper valuation is important.

Disclsoure: Investment in securities, including mutual funds, involves the risk of loss.