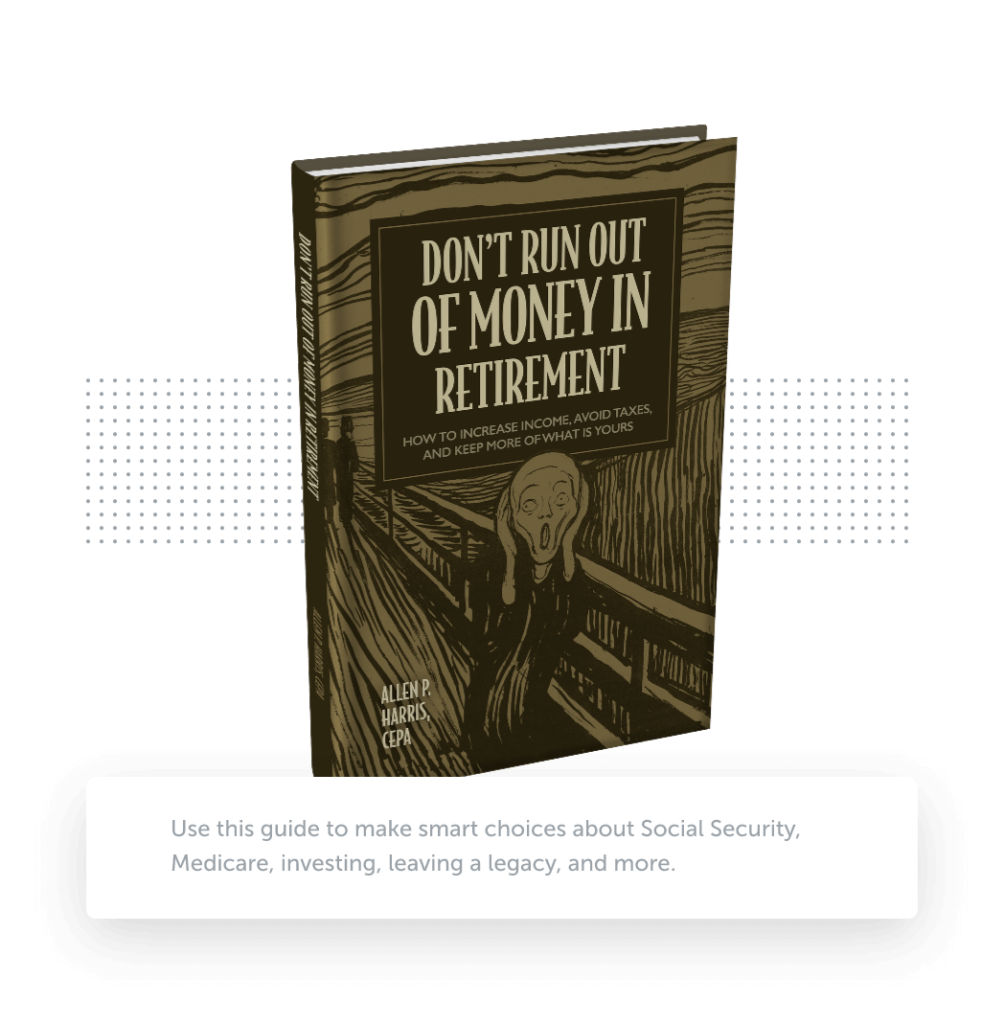

WILL YOU HAVE ENOUGH

TO SEE YOU THROUGH RETIREMENT?

In Don’t Run Out of Money in Retirement, veteran money manager Allen Harris helps answer this question — along with many other questions you might have. From long-term care, to Social Security and Medicare planning, through how to prepare for taxes and inflation while leaving a sustainable legacy.

Available as a complimentary digital download with scheduled consultation.

— NOW AVAILABLE —

I’VE BUILT A CAREER ON HELPING PEOPLE MAKE BETTER FINANCIAL DECISIONS.

ALLEN HARRIS

Allen Harris has helped hundreds of clients build steadily toward retirement success. Navigating both calm and stormy waters for more than two decades, he continues confronting the bears and running with the bulls as a veteran of the dot-com bubble, the Great Recession, and the longest market expansion on record. Allen’s career also includes the founding of a highly successful financial newsletter and work at Smith Barney (now Morgan Stanley). He is the co-founder and Chief Investment Officer of a boutique advisory firm.

A REAL-LIFE SUCCESS STORY.

Allen Harris is the founder, owner and Chief Investment Officer of Berkshire Money Management, based in Western Massachusetts — a firm launched with the mission of helping individuals and their families build portfolios while protecting their assets in even the most serious of downturns. In addition, he manages a dedicated consultancy for business owners.

Beyond this professional work, Allen is passionate about the well-being of animals and community engagement, providing ongoing, dedicated support to economic revitalization efforts, local arts programs and food security initiatives. Learn more about his business ventures at the dedicated sites below.

Berkshire Money Management is a boutique, fiduciary wealth management firm based in the Berkshires of western Massachusetts. When investment management is no longer enough, successful professionals and business owners rely on our team of financial advisors and CERTIFIED FINANCIAL PLANNER® professionals to turn complex financial questions into clear next steps for retirement, inheritance, divorce, new beginnings, and more.

WE ALL WANT THE SAME THING, ENOUGH TO THRIVE IN RETIREMENT

WILL YOU HAVE ENOUGH?

Can you afford that dream vacation? What if you need long-term care? Will you leave a legacy to your kids and grandkids? Or to charity? Can you help pay for their college? How do you best deal with taxes and inflation? How do you manage Social Security and Medicare? And what if the economy crashes again — how can you prepare?

Don’t Run Out of Money in Retirement will give you a jump-start on planning for a long and prosperous retirement.